Learning about personal finance as a kid sets a solid foundation for managing money for the rest of your life, so congrats on taking steps now to learn about what paychecks are, who gets a paycheck, how to get a paycheck, and the basics of what’s included in paychecks!

My first job was working at a thrift store at 15, and my first paycheck was a little shocking because no one had told me about paying taxes yet or that part of my paycheck would be held by my employer to cover taxes and retirement contributions.

What Is a Paycheck?

A paycheck is a check paid to an employee by an employer in exchange for the employee completing work for the employer. Employees can get their paychecks in a physical paper check or through an electronic deposit into the employee’s bank account.

Many employers will pay employees every two weeks, but some will pay weekly or monthly, so it’s important to understand how often you will be getting paid so you can plan your expenses and spending.

One important note is that your first paycheck may not be distributed by the end of the first pay period after starting the job because payroll needs time to process the time you’ve worked. Because the first paycheck is delayed, employees need to plan their bills and spending to allow for this delay. It’s helpful to have savings to cover your bills and living expenses until you get your first paycheck.

When I left the military and got my first job, I didn’t know that I wouldn’t get my first paycheck for almost a month after starting work, and I didn’t have enough savings to cover my expenses, so I had to take out a loan to temporarily cover bills until I got my first paycheck. That was a hard time for my family that could have been prevented.

What’s Included in a Pay Stub?

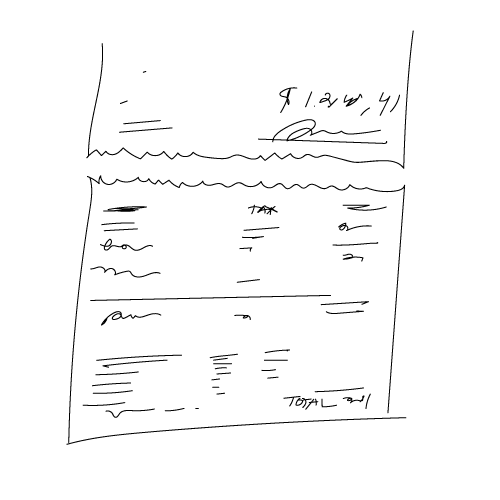

A pay stub or pay slip is a record of the paycheck that gives a summary for both the employee and employer to reference. Sometimes, pay stubs are electronic statements that require a login but will be given with your paper check as an attachment if you choose the paper check option.

A pay stub shows:

- The pay period

- Employee information such as pay grade and pay rate

- Employer information with address

- Gross earnings (Total earned before taxes and deductions)

- Net earnings (Total earnings after taxes and deductions)

- Withholdings such as taxes, insurance payments, and retirement contributions

- Benefits the employee received such as vacation or sick time

How Do You Cash a Paycheck?

If you receive a paper check from your employer, you can either cash it at your local bank branch or deposit it into your bank account. To cash your paycheck at a bank, you need to have a bank account with that bank.

Employees that don’t have a bank account and/or aren’t able to open one can pay a fee to cash their check at a check cashing establishment or use the check cashing service at major establishments like Walmart or grocery stores like Food Lion.

Contact Human Resources and ask them to set up an automatic deposit into your bank account. They will give you a form to fill out that asks for your personal information and bank account information to give your permission to the employer to deposit your paycheck electronically.

Who Gets a Paycheck?

Everyone that works a job receives a paycheck from their employer. Salaried employees will receive the same amount of money every paycheck regardless of how many hours they work during that pay period, so they may end up working more than the standard 40 hours per week that is considered full time.

Hourly employees are paid for every hour worked, so each paycheck may differ based on how many hours worked during that pay period. After the first 40 hours of work, most employers will pay an extra incentive for every hour worked. Incentives usually include time and a half or double time, which means that the employee gets paid their standard hourly rate plus an extra amount equal to 1.5 or 2 times their hourly pay.

Some employers will offer bonuses to employees as incentives for working hard, meeting quotas, or exceeding expectations. These bonuses may be included in your regular paycheck or a separate check.

How Can Kids Get Paychecks?

Kids can get paychecks in exchange for performing work tasks just like adults can, but there are labor laws in effect both federally and by state, so it’s important to know what the Department of Labor guidance is for child labor.

One important note is that there are different laws for agriculture and non-agricultural employment for kids, so it’s important to make that known when you file taxes at the end of the year.

If you aren’t old enough to qualify to work for an employer in your state, you can ask your parents, neighbors, friends, and other adults in your community if they would be willing to pay you for your time or skills and allow you to work for them on a part-time basis. Remember that you should still pay taxes on money earned outside of a traditional work environment or ask your parents to claim your income on their taxes.

Some ideas for jobs for kids include:

- Babysitting

- Lawn care and maintenance

- Running errands for neighbors

- Lifeguard for city or neighborhood pool

- Pet sitting or dog walking

- House cleaning

- Paper delivery

- Vehicle washing and detailing

- Cleaning up after dogs

- Shoveling snow in your neighborhood during the winter months

What other ideas can you think of to make some extra money and earn a paycheck?

Paycheck Basics

Other important tips to know about paychecks:

- Compare your pay stub regularly with the amount of money listed on your paycheck to ensure you are getting paid the correct amount. Look over your pay stub to ensure you are receiving the benefits you should be receiving and verify that your employer is pulling the right amount of money for withholdings and deductions. If you notice something doesn’t look right, try to address the problem as soon as possible.

- Many employers will use a third-party payroll system to process your paychecks, so you may need to register for an online account with this third party to view your pay stub or make changes to your withholdings or bank account information.

- Sometimes, your employer may not pay you on time, and you have to know that you have the right to be paid on time and the agreed-upon amount. If you aren’t paid on time, the first stop is to ask your employer’s human resources or payroll department about your paycheck’s status. Hopefully, it’s an innocent mistake, and your paycheck will be issued immediately. If you don’t get the answers you want from human resources, you can write a letter to your employer formally asking for your paycheck to be issued.

- If the employer is holding your paycheck without cause, you can contact your state employment enforcement office or the state labor department. Some lawyers specialize in labor issues, so you may need to seek their services after conversing with the labor department.

- Keep your pay stubs for your personal records because they show your employer’s information and the withholdings from the current calendar year broken down by pay period.

- Your withholdings and deductions aren’t the same as your fellow employees because your situation differs from theirs. Withholdings change from person to person based on marital status, number of dependents such as children, insurance premiums, and wages you’ve been paid.

- Sometimes money is withheld from your paycheck because of a court-ordered or tax collection wage garnishment used to pay a debt that you owe for: student loans, child support, or back taxes. To prevent wage garnishment, take action to make arrangements to pay your debts on your own.

Bottom Line

Paychecks are how employees are paid by employers for work that has been completed. Paychecks can be issued as paper checks or deposited into your bank account electronically after every pay period ends. Withholdings and deductions are subtracted from an employee’s paycheck to cover items like taxes, retirement contributions, insurance premiums, and wage garnishments.

Understanding what paychecks are and how they work is a significant first step towards learning about financial independence as an adult, but there are many steps that you can take as a kid to set yourself up for success with money! If you want to start collecting a paycheck of your own and have some extra spending cash, sit down with your parents and talk about how to get started and where to look for your first job.