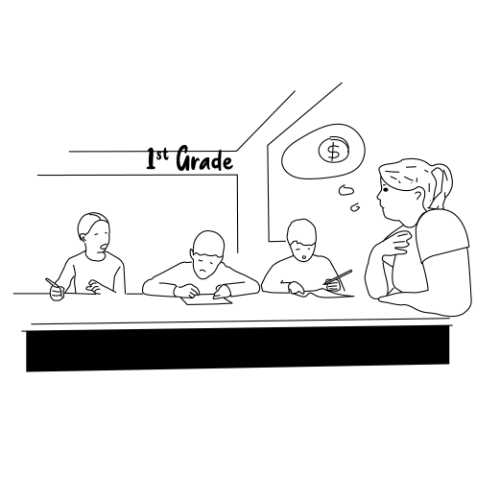

Early elementary school is the perfect time to begin teaching kids about money. They may have seen examples of coins and bills in Kindergarten, but in 1st grade, they dive deeper into understanding how money works and its worth. Students at this level learn many concepts, and teachers and homeschoolers need to hit the essential ones to keep kids on track for their future financial education. According to the Fifty Nifty Econ Card program organized by the Federal Reserve, 1st-graders should learn vital topics such as resources, bartering, money, earning, spending, and saving. By teaching these central subjects, you give these young learners a solid platform to build their money knowledge. Let’s look into what precisely you should cover, how to teach it, and some lesson plans to get those kids on their path to financial success!

National Standards for Personal Finance Education

Download Our Free Teachers' Cheat Sheet

Our free cheat sheet covers every learning objective in the National Standards for Personal Finance Education and the corresponding Kids' Money Lesson Plans - we cover each and every standard!

Resources

Resources are the building blocks of economies everywhere. You can explain to students the many types of resources and how people make goods and services using various materials. You can get into how different regions have their resources, and, as a result, make products that are unique. You can get into the idea that resources are limited, describing how some resources need to be brought in from other areas, and others are locally produced.

You can teach the concept of resources in many different ways. 1st-graders like hands-on activities, of course, and there are many approaches to engaging your young scholars. For example, you can:

- Have students create colorfully illustrated maps showing their state, city, or community resources. They can label the main items available nearby and list various goods and services that companies can produce with those resources.

- Have students pick their favorite toy or game. You can help them determine what resources went into producing their items and try to figure out which elements were likely sourced locally and which were brought in from outside.

1st Grade Lesson Plan #1

Resources

Want to Get All 1st Grade Lesson Plans?

Barter

The idea of barter is an ancient custom going back to early civilizations, and it set the table for modern economics. People have different needs, and barter is a way to trade for items you need. You can cover this idea that humans can use trade to their advantage while fulfilling others’ needs. As students deepen their knowledge of this concept, they will have a foundation to learn about trade and business, and how countries actively use these strategies to grow and develop as nations.

While bartering is not nearly as common as it once was, kids can learn the process and see how it can benefit all parties. There are lots of fun activities for your 1st-graders to take part in, including:

- Lay out several items that your kids can choose between, letting them create a pile of objects. You can have them explain why they chose what they did, describing how these objects improved their worth. They can barter with classmates until they are satisfied with their collection of items.

1st Grade Lesson Plan #2

Bartering

Money

This topic is arguably the most important one that your 1st graders will learn this year. By the time second grade comes around, students should know the value of pennies, nickels, dimes, quarters, and various dollar amounts. You can cover how goods and services have different costs and how much everyday products cost in-store or online. Students can practice counting money by combining paper currency with coins to add specific amounts. You can show students that there are many ways to get money, introducing the idea of work and receiving paychecks. Discussing the history of money is a great idea, showing the kids that money has different values around the world and that you can learn a lot about cultures through symbols, words, and pictures printed on currency.

You will notice many varieties of ways to teach 1st-graders about money. You can show them how to use and understand it through:

- Have students go through coins and bills, creating totals that you want them to reach. Depending on how much they have, they will understand the limits of money, and see that some items will use up more significant chunks of their money than others. You can use paper models of the currency or real coins and bills, having them “buy” items at a pretend store.

1st Grade Lesson Plan #3

Money Value

Earning

Earning is the idea of receiving money in exchange for providing work. There is a lot of information to cover on this topic - with many different ways to earn - so knowing what to focus on is crucial. You should cover the idea of careers, explaining that some jobs pay more than others. By connecting their understanding of different jobs – like what their parents do for a living – they can see how the system works, that the more hours you put in, the more money employers pay. You can get into the different ways you can earn money with traditional methods and techniques to make money online. Students can see the reward of getting a paycheck after working for a set amount of time and can begin to dream about what their future careers may be.

Teaching about earning can unlock student curiosity, and there are many avenues to explore in this topic. As an educator of 1st-grade students, you can:

- Create a working earning system in your classroom or homeschool setup. Kids can make play money by completing chores in class, cleaning up stations, passing tests, and being kind to one another. They receive coins and bills, keeping it in a secure place just as they will need to in life later. You can set up a classroom store, where they can buy actual items with their earned money by completing these different tasks. They will learn the importance of making significant amounts and managing what they earned wisely.

1st Grade Lesson Plan #4

Earning

Spending

1st-graders can begin to see how they can spend money in various places. As their teacher, you can start to demonstrate how to spend wisely. For example, they should not spend all their hard-earned money on one major purchase unless they have planned carefully and decided it is worth it. You may go over the many places you can spend money, including stores, gas stations, theme parks, and websites. There are multiple methods to pay, too, and you may show the students how you can use a card instead of cash to buy items. You will want to teach how to manage spending and to try to consistently dedicate some of your earnings to saving.

The methods to teach your students about spending money are limitless, but you can find many fun and engaging ways to get them well-educated about spending. Educators can show the many ways to spend wisely by having their young learners:

- · Use their money at a virtual grocery store. They decide which items are the most important to buy, which products are more of a want than a need, and which things they probably should avoid purchasing. Students will see that spending is part of life, but knowing how to manage how they use their money is vital.

1st Grade Lesson Plan #5

Spending

Saving

One of the most valuable lessons you will provide to your students in their 1st-grade year is saving. If you can drill down this idea - that they will accumulate wealth over time by holding onto their money– you can give them a skill that will last a lifetime. Teachers introduce the idea of putting money into savings accounts and other forms of storing earnings, planting the seed that they should save lots of the money they make. Students should understand that savings accounts are the safest place to keep their money, and there are many reasons for personal savings. You can explain that cars, homes, and other big-ticket items cost a lot of money, and the best way to buy those products is to save earnings over time.

You may approach teaching the concept of saving in multiple ways. An engaging way to get kids on board with keeping their money in the future is:

- Show the students the power of saving. Give them an allowance in class (with pretend money). Let them spend 50% of their budget on items in the student store while saving the other half in their “savings accounts.” After several weeks, revisit their savings accounts to show them how much money they have due to putting away cash. You can have them decide on the reward they want, one that costs a significant amount of play money, like extended recess or free time, and show them how rewarding it can be to save.