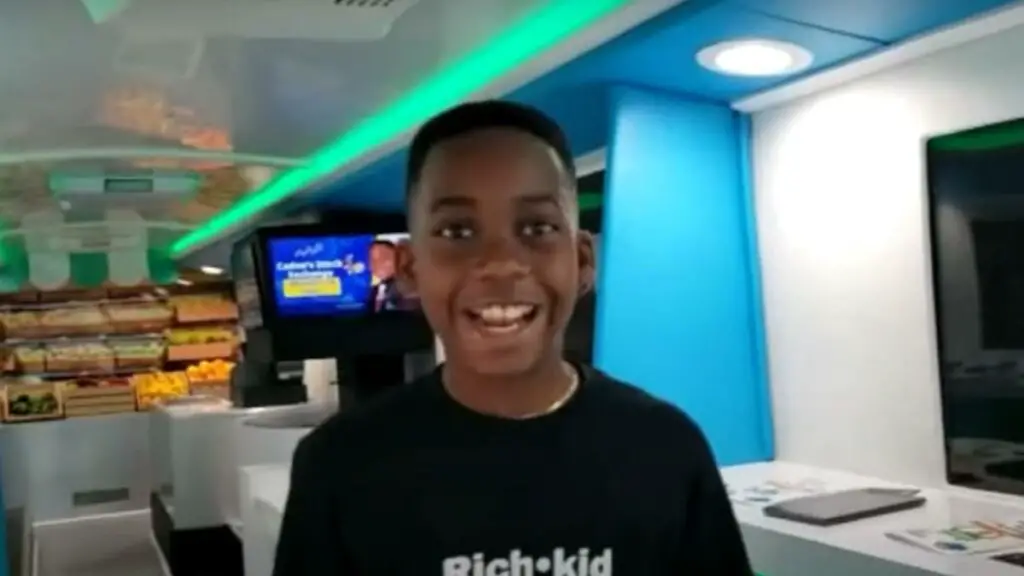

While many children may take little interest in their parents’ careers, Caden Harris of Atlanta, Georgia quickly took to his father’s interest in business. At age 7, Harris started studying business concepts illustrated in meetings held by his entrepreneur father. Although he is too young to get his driver’s license, Harris has purchased a bus that he is turning into a “mobile financial literacy classroom.” Harris sought investors among Atlanta-area businesses to get the old bus into rolling shape. The renovated bus has interactive exhibits to help kids learn about saving, budgeting, and investing. As amazing a feat as the mobile financial literacy classroom is at age 11, Harris hopes to expand and eventually have a mobile classroom in every state!

Free Programs Exist for Elementary and Middle Schoolers

Unfortunately, most young people across the United States won’t be able to visit Caden Harris’ financial literacy bus. However, free programs exist nationwide to help middle school and even elementary students learn about personal finance. The U.S. Department of Education has compiled many educational resources for children and teenagers, most from federal government agencies like the FDIC (Federal Deposit Insurance Corporation, which oversees banks) and the Treasury Department. Some educational programs have different material for each age level (young elementary, older elementary, middle school, and high school).

Although few resources may compare with an interactive bus, the Consumer Finance Protection Bureau (CFPB) has lots of resources for schools, including free finance- and money-related posters that can be ordered for classrooms. A user-friendly website, courtesy of Hands on Banking, has many free learning options for teens and college students. For young people who want to move from saving and budgeting to more advanced topics like investing, How The Market Works.com has plenty of resources for students, teachers, and college professors. It includes stock market simulators and introductory lessons that explain how stocks and bonds work.

Next Gen Personal Finance offers many lessons for middle school and high school students, with user-friendly materials for teachers. This includes interactive material that can be used on students’ electronic devices like iPads and laptops. Courses can be adapted by length, with 9-week, semester (18-week), and year-long (36-week) options available. Fortunately, this adaptability allows teachers more chances to use personal finance curricula as part of existing classes!

Individual lessons are available through Junior Achievement USA, which can be filtered by elementary, middle school, or high school level. Although not necessarily full-class scale like Next Gen Personal Finance, the modules offered by Junior Achievement can be used within existing middle school and high school math and economics classes. Giving students a change of pace from the normal curriculum can be exciting and boost engagement and knowledge retention. Another good source for individual lessons is 4-H, which has several finance lessons ranging from 20 minutes to 1 hour in length.

And don’t forget about our Kids’ Money Lesson Plans!

Moving Financial Literacy Forward

So, even for students who cannot make it to Georgia, there are plenty of good financial education resources for kids ages 6-18. However, schools and school districts should make an effort to develop interactive exhibits to enhance student engagement when it comes to learning about finance and economics. Hopefully, more young people like Caden Harris will develop tools to help their peers learn about money and have fun while doing it!