For many kids, the concept of stocks feels abstract. For most parents, trading stocks is an obscure art that happens in a faraway land called Wall Street. How are you supposed to explain stocks to your child when you’re no investing expert yourself?

Fear not, financially forward parents. We get it. And we’re here to tell you that having the “stock talk” can actually be fun for you and your kiddo! In this post, we’ll break it all down so you can feel empowered to teach your child the basics of stocks.

Ready to unleash the power of compound interest and unlock wealth for your child? Here we go!

Why Teach Your Kids About Stocks

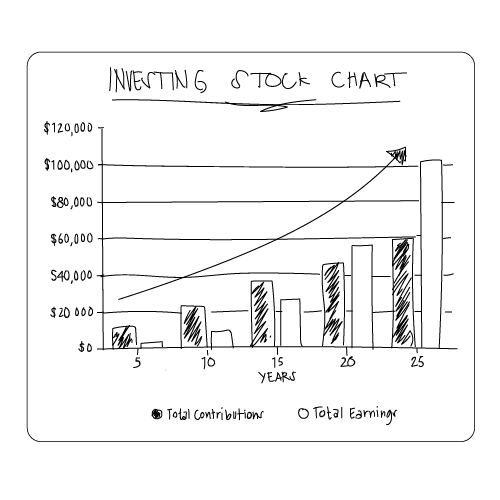

The main reason to teach your kids about stocks is because investing can be a great way to generate wealth. The sooner your kid learns how the stock market works, the more time they’ll have to make their money grow. But the best news here is that by helping them understand the basics, you can give your child the confidence to make educated investment decisions that will impact their financial future.

Here are some of the benefits of teaching your kids about stocks at an early age:

- Learn how to make money work for you

- Appreciate how savings can only go so far in creating wealth

- Learn to budget and diversify their money into savings and investing

- Be more aware of the world around us and how national and world events impact the market, which in turn impacts the value of the shares

How to Explain Stocks and the Stock Market to Your Kids

As with other money topics, it’s best to start with the basics in kid-friendly terms. Let your child’s curiosity guide you, and add more info as needed. If you hit a roadblock and feel unsure about something, remember that researching right alongside your kid can be a great shared experience!

Having said that, let’s start with the bare-bones basics of stocks and how they work:

The first concept to explain is that stocks are measured in shares. Just like a bag of apples can consist of six, twelve, or any given number of apples; stocks can also consist of any number of shares. And like each of those bagged apples has an individual value, each share has a value in dollars.

Just like when you go to the market and buy apples for a specific price, you can also go to the stock market and buy shares of a company for a specific price. These shares represent ownership of the company. So by buying shares, you become co-owner of the company.

But, in the same way that apples can be more expensive one day and then go on sale the next, stocks can also gain or lose value over time. When you buy stocks of a company, your stocks are tied to the company you’re investing in. If the company grows, your shares are worth more. But if the company doesn’t do well, your shares will go down in value.

What Is Stock?

After you’ve introduced the topic as we did above, your child may want to know what a stock is. It’s only logical. Here’s a simple breakdown that you may find helpful:

- A stock is a financial instrument that represents ownership of a company

- The units of stocks are called shares

- Stocks are sold and bought in stock markets

- The value of a share goes up and down depending on many factors

- If the value goes up and you sell your stocks, you can make money

- If the value goes down, you might be better off waiting until the price goes up again to sell your shares

This might be a good time to introduce an example before your kid’s eyes go wide and you start to lose their attention:

Let’s say there’s this company that sells phones. You like the phone, you like what the company stands for, and the phones are very popular. You decide to buy 10 shares of this company at a price of $100 per share, for a total of $1000.

Because the phones sell very well, over time, the shares go up in value to $120. The total value of your investment goes up to $1200. Nice!

If you were to sell your shares now, you could make a profit of $200. Instead, you decide to hold on to your shares because the company’s about to release a new phone, and you hope the value will go up even more.

Sadly, the new phone turns out to have many bugs, so the product is no longer popular. The share price drops to $80, and your stock is now only worth $800! At this point, you could decide to sell and lose $200 from your initial investment, or you can hold on to your shares in the hopes that the company recovers.

That’s it. That’s the basics of how all shares work. You can buy, sell, or hold depending on your outlook for the company and the economy as a whole.

What Is the Stock Market?

Your child’s question might be more along the lines of “So, where is this stock market, and can we go there?” It’s a fair question. After all, you compared the stock market to the grocery store.

Back in the day, the stock market was a physical place where traders and brokers could do transactions on behalf of individuals and companies. But these days, most stock markets are virtual.

Thankfully, your kiddo’s a digital native – so this will be a super easy concept for them to grasp. Phew!

How Many Stock Markets Are There?

As of today, there are 60 stock markets around the world. The US has the two most important markets in terms of combined wealth that gets traded.

The New York Stock Exchange (NYSE) and Nasdaq are the two main stock markets. According to Wikipedia, the NYSE has a trading volume of $1.5 billion, and Nasdaq follows closely behind at $1.3 billion.

What Can You Buy and Sell in the Stock Market?

The stock market allows you to buy and sell shares of companies that are publicly held. This means that those companies are no longer private, like your favorite neighborhood restaurant. Instead, these are large corporations – think more along the lines of big restaurant franchises.

As the name suggests, stocks are the bulk of the trading in the stock market. But there are other financial securities that you can also trade. These include exchange-traded funds (ETFs), derivatives, commodities, and currencies.

Glossary

Knowing a few basic stock market terms will help you and your kiddo gain the confidence you need to start your investment journey. There are more terms you can explain to your child, but these are the very basics to get you started.

Sell: To exchange your shares for money. When you sell your shares, you no longer own those pieces of that company.

Buy: To pay cash in exchange for shares. When you buy shares, you gain ownership of a piece of that company.

Hold: This is when you refrain from selling. You can do this when the shares go up in price, in hopes that they will still go up even higher. You can also hold when the shares go down, in hopes that they will go back up.

Shares: The units of stock that represent ownership of a company.

Resources & Strategies to Teach Your Kids About Stocks

A great way to bring this knowledge to life is by making it part of your every day. Thankfully, there are tons of great resources that you and your child can use to learn about stocks and become comfortable with the stock market. Here are some of our favorites:

Hands-on experience is a great way to learn about the stock market. But how do you do that without risking actual dollars? Check out the Stock Market Game, an online simulation of the stock market designed for families to have fun while honing their selling and buying abilities. In this interactive game, each player is given $100,000 of pretend money to trade. We love the Stock Market Game because it’s appropriate for all ages, but we suggest having younger players participate as a team as an exciting way to get the family involved.

If you have teenagers in the house, download our Kids’ Money tracking stocks worksheet that will help your kids learn how to follow the stock market and make smart investing decisions.

If your family’s into board games, we suggest CashFlow. Perfect for kids six years and older, this is a great way to learn the basics of saving and investing while having a blast. The goal of the game is to earn the most passive income and reduce your expenses and liabilities. Your kid will develop an intuition about how investment works just by playing!

And for the youngest members of the family, we suggest My Stock Market Workbook – because who doesn’t love coloring, connecting the dots, and tracing?! Created for families and young ones, this workbook can help enhance children’s vocabulary, reading, and math skills while providing stock market knowledge from an early age.

Let’s Unleash the Stock Market Family Fun!

Investing is an essential part of your child’s financial literacy. Besides teaching your kid how to become financially independent from an early age, there’s great fun to be had investing in stocks! Especially if you take it one step at a time and make it part of a wholesome financial education.

Once your financially-savvy kiddo has mastered the basics of stocks, you can talk about opening a real investment account and finding a professional advisor to guide them. This will be a great opportunity to discuss your kid’s financial goals, strategies to achieve them, and have fun on this financial journey!

Related Reading For You and Your Kids

- How to teach your kids about investing

- How to teach your kids about diversity in investing

- How to teach your kids about bonds

- How to teach your kids about MMAs

- How to teach your kids about mutual funds

- How the stock market works for kids

- Investing 101 for kids

- Investing for teens

- Investing for college students