When it comes to raising a financially responsible child, there are various approaches that can be taken to ensure they live by and uphold this hefty title.

Finding the most effective approach to teaching means your kid is sure to become the magnificent money mastermind that you’d always dreamed they’d be!

The question is this: What is one of the most well-known methods used in teaching kids about money and budgeting?

If you’re unfamiliar, the 3-Jar Method of Save, Spend, Give is a one-of-a-kind approach to teaching your child about savings. The way it works is by splitting up your money into different categories.

For your child to learn how to manage money, they need money to manage.

They might earn money through small jobs such as babysitting, mowing a neighbor’s lawn, or selling lemonade at a stand. Other ways of earning money may involve family and friends giving monetary gifts and allowance.

However your kid earns it, they’ve earned it, and therefore it is theirs! Let them feel confident in that right, which will get them excited about starting to budget! When your child has earned an allowance or an incoming source of money, you can now help them decide how the money they’ve received gets divided into jars.

The 3-Jar Method is widely used as it encourages kids to learn about budgeting and comes in handy at any age! A fun fact: kids learn to manage money as soon as they can count to three!

Getting your kid started down this path will benefit them greatly, and they can get started by saving today!

In this article, you will learn about the 3-Jar Method of Save, Spend, Give”, the right percentages to use, how to implement the three-jar method with your kids, and “Save, Spend, Give” banks to help get you started.

What is the Three-Jar Method?

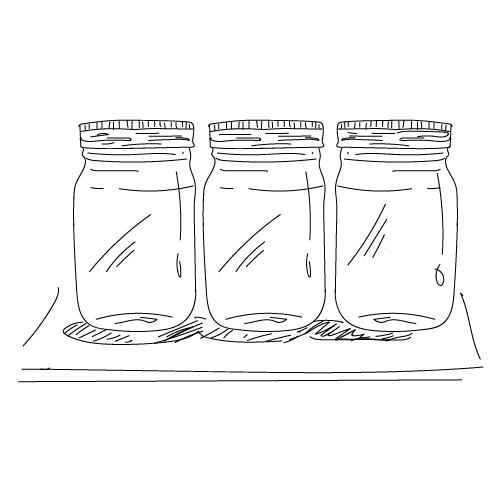

The 3 jar system is a creative way to start your child down an optimal path to budgeting. This system requires that you give your child three clear jars that each represent a particular fund type: spending, saving, and giving. The child will then divide their money into the jars with your direction.

By budgeting their money in this way, they learn to play an active role in their own current and future money decisions that will dictate how successful and in control of money they’ll become in the future.

Try and get your child to stay within a budget they agreed to set for themselves. If they drift away from the prize, see if you can coach them through improving the undesirable money habits and behaviors that keep them from sticking to the process. Another important point to note is how important it is as a parent and caregiver to lead by example.

What is a Savings Jar?

Since saving is the foundation of building wealth, paint a lovely picture of the final product to your child. Your child needs to have something to look forward to as motivation. Even adults need something to look forward to!

Delayed gratification is the act of resisting an impulse to take an immediately available reward in the hope of obtaining a more valued reward in the future. In this case, saving up enough funds for that prize you so slowly and steadily anticipated gives you a much better feeling of accomplishment and satisfaction. Having a conversation with your kid will help them to see that there’s a difference between saving for a toy and a college fund.

Another important part of teaching your child to save is creating a general “rule” that helps them to understand how much of their earnings can be distributed between the three jars. For example, 20% of the money they earn or are given should go straight to their savings jar. This is a fixed amount that will give them consistency and discipline. Another smart move that’ll have them controlling their spending is by enforcing a policy whereby for every $2 added to the spending jar, $1 should go to the savings jar. You can play around with the figures and see what works best, ensuring they remain dedicated to the 3-Jar Method of saving and ultimately building a lifelong habit.

What is a Spending Jar?

Spending money is something that children seem to know how to do with their eyes closed. Your child should be able to start a list of ongoing and fixed expenses, such as their phone bill, school lunch money, weekend outings, and extracurriculars. Let them understand that fixed expenses tend to be necessities, and variable expenses are optional. An example you can use for fixed expenses is a monthly mortgage, phone bills, and car insurance payments. Variable expenses are vacations, dining out, groceries, and shopping sprees.

What is a Giving Jar?

The giving jar is unique, and kids should see it as very important. It encourages them to think about others. You can help them see how giving helps others and makes the giver feel good about their generous and kind act. To utilize this particular jar, ensure they see the action performed by family members and close friends. Allow them to get involved with supporting organizations of interest. Another way to get them on the giving wagon is by showing them the ways you give back! The giving jar can help fund gifts for other people – birthdays, get well gifts, and surprise moments.

They should also be aware of the impact of their generosity and how a little bit of giving goes a long way!

What are the “Right” Percentages for the Three-Jar Method?

Just as there is a general rule for saving money in the savings jar, there are generally recommended percentages for what amount of money should be allocated to each jar.

The assumption is that your child should know how and why people prioritize. Some things are just simply more important than others and need to be handled as such. The 3-jar method is no exception.

This area is best for older kids and teens to grasp since they are more involved in their finances. However, you can still work side-by-side with smaller children to help them understand the same concept.

There is no single “right” percentage.” When it comes to percentages, it is ultimately up to the parent and child and what’s most suitable for the family within their financial situation. Generally, though, it is wise (and practical) to allocate the largest amount to spending. Spending is something we can’t hide from and is done on a daily basis. Therefore, help your child to understand that this doesn’t mean they should spend for the sake of spending and that by using the 3-Jar Method, they can control how they spend and what they spend their money on.

Take a look at this general percentage to consider and follow:

Spending – 55%

Saving – 30%

Giving – 15%

How to Implement the Three-Jar Method with Your Kids

The best way to get started implementing the 3-Jar Method with your kid is by first letting them in on the secret. The secret is simple – all money is not created equal. Some belong in savings for later, longer-term use, while others are more or less expendable and can be rid of quickly based on needs and wants.

To start putting your words into action, grab three jars (preferably a 16oz wide mouth or greater). Create tags that read one word per jar – “save,” “spend,” and “give.” As you attach each tag to a jar, brief your child on why the money they earn will go into the jar and into that particular one. After the jars are all labeled, you can start the budgeting!

“Save, Spend, Give” Banks to Help You Get Started

Here is a quick recommendation list of our top banks that parents can use for the 3-Jar Method to enhance their child’s interest in saving money and get them further along in their budgeting journey:

Moonjar Three-Part Moneybox

Suggested age: 6+ Months and up

This lovable, award-winning “save, spend, share” money box appeals to both child and parent. Perfect for smaller children due to its color code, size, and compactibility, it’s a great first starter for younger children that are beginning to learn about the very basics of math. Another draw in for tiny tots is its ability to be pulled apart for playtime! Sounds like a win-win!

Smart Piggy Trio Bank: 3-in-1 Money-wise Educational Piggy Bank

Suggested age: 12 years and up

This money-wise educational toy is a great gift for any child who is ready to learn basic economic concepts and is interested in saving and budgeting their own finances.

Learning Resources Wise Owl Teaching Bank

Suggested age: 3+ years and up

This learning toy helps develop money awareness and introduces early money management skills, including budgeting, charitable giving, and saving towards a goal. A fun perk to this wise owl is that it includes a random option: when your toddler drops a coin down the top slot, it lets the owl decide whether it goes in “spend, ” “save, ” or “share”!