You’ve worked hard to write a great resume, apply to jobs, interview, land the job, and then worked your first shifts, so now the big day has arrived to FINALLY get your first paycheck! Congratulations on such a huge milestone!

When you get your paycheck, you may be a little confused as to why it’s not as much as expected. A pay stub is sent out by your employer when your paycheck is issued, and this is a breakdown of what you’re being paid after all deductions have been taken out.

Common pay period intervals are: weekly, biweekly, and monthly, but some employers that pay based on commission will have other pay periods, so find out from your employer how often you will be paid.

Taxes aren’t the only monies withheld by your employer from your paycheck so let’s discuss how much you’ll get paid for the hours worked and what to expect from your first pay stub!

What Is a Pay Stub and Why Is It Important?

My first paycheck as a teen was a shock because no one had told me that I wouldn’t get paid the total hourly wage that I had agreed to when I took the job. After I received my first paycheck via deposit into my bank account, my manager was kind enough to explain the breakdown to me, so I knew what to expect going forward.

Many employees nowadays rely on direct deposit through their employers to have paychecks deposited directly into their bank accounts without having to cash a physical check. Because of this convenience, checking your pay stub every pay period is even more important to ensure you’re being paid correctly and deductions are accurate.

Hourly employees will see how many hours were worked during the pay period and overtime hours worked, whereas salaried workers will see your salary plus any bonuses or incentives earned during the pay period.

A pay stub has three main sections: an explanation of how much money has been paid for the number of hours worked, how much has been withheld for taxes, and other withholdings with their purpose. This allows you to understand how much money you are making consistently, so you’re able to budget and plan where your money goes.

As an employee of a company, it becomes our responsibility to ensure our information is up-to-date with the payroll department. Be sure to update your address or withholding information, such as marital status or number of dependents that you’re claiming on your taxes at the end of the year.

What Are Pay Stubs Used For?

Pay stubs are used by employees to understand how much you’ve been paid and should be checked regularly by employees for accuracy. You work hard, and want to ensure you’re being paid everything you’re owed for the time worked.

Pay stubs are used to apply for loans with banks or assistance applications for services such as public housing or food assistance programs. A pay stub provides an official certification from your employer of how much money you are being paid regularly in your employment efforts with them.

Your pay stub will show how much you are paying for taxes, especially in three major areas: Federal Income taxes, State and Local taxes (SALT), and FICA taxes. Federal taxes are calculated based on a percentage of your annual earnings and the number of dependents reported on your W-4 to the government, then divided by the number of paychecks you’ll have for the year.

Some states, such as Texas and Florida, don’t have state income taxes, so employees in these states will only pay their federal tax obligations. Some local cities and counties will impose local income taxes while other areas don’t.

Everyone pays 6.2% of their gross income directly into Social Security, while your employer will pay the other 6.2% for you to cover the current total tax burden per employee. Self-employed individuals will owe the full total because we don’t have an employer to cover half for us.

Common Abbreviations on Pay Stubs

Let’s break down how to understand your pay stub and what commonly used abbreviations mean, so you know where your money is going! Taxes paid by an employee are determined by where you live, the number of dependents you claim on your taxes, and where you are paid. If you live in one area and work in another, your tax rate may reflect this.

- Gross Pay: Total money earned before deductions are taken out.

- Net Pay: How much money you’ll get paid after deductions are taken out.

- Current earnings: Total earned during this pay period.

- YTD: Year-to-date (often used in reference to how much you’ve earned so far this year or how much has been paid in taxes so far this year).

- Reg: Number of regular hours worked this pay period.

- OT: Number of overtime hours worked this pay period.

- HOL: Holiday hours worked during the pay period.

- VAC: Vacation time taken or paid out during this pay period.

- FL & SICK: Family leave and sick leave paid out during the pay period.

- FICA (Federal Insurance Contributions Act): Social Security taxes paid by you as the employee. The employer pays part of the Social Security taxes for you, too, but that is not deducted from your paycheck because it’s deducted from their business profits.

- FICA-MED: Medicare deductions paid by you as the employee.

- Fed or SWT: Income tax deductions for federal withholding (Income taxes are a percentage of pay taken out based on your hourly wage and how many hours you worked during the pay period.).

- State or SWT: Income tax withheld for state taxes.

- Local tax or LT: Local taxes paid to your local city or county as income tax.

- Workman’s Comp or WC: This is an insurance that protects you as a worker if you get hurt on the job and will pay your wages for a designated period of time after an injury. This is usually paid by the employer on your behalf.

- MED or INS: Medical deductions for healthcare savings accounts or insurance premium deductions.

- Life: Life insurance deductions.

- Ret or 401k: Tax-deferred retirement contributions.

- Garnish or Garnishment: Money deducted from your paycheck based on money owed to a third party.

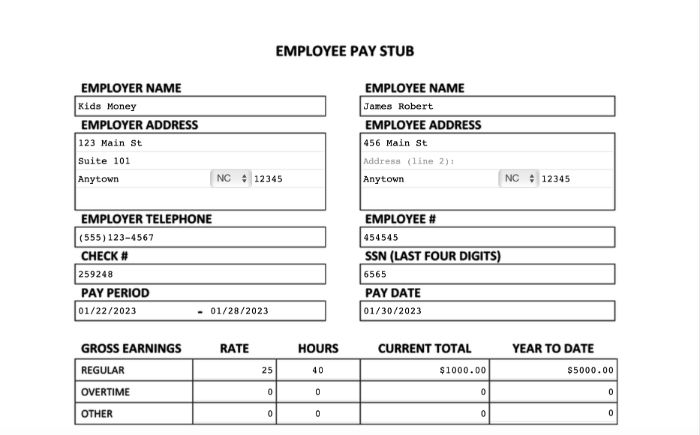

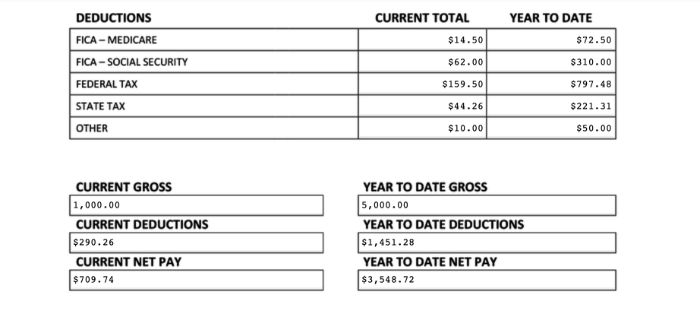

Sample Pay Stub

This pay stub shows the following:

- Employer Name- Sometimes, this may be listed as a parent company instead of the company you actually work for.

- Employee Name- This is going to be listed as your full name and not a nickname.

- Employer Address- This address may be for your local location or for the main headquarters of the company.

- Employee Address- This address needs to be updated in order to ensure your tax rates are correct and that you are receiving your pay stubs, tax documents, and mail from employer.

- Employer Phone Number- This is usually the main office number but is sometimes listed as the number to your local location or the Human Resources Department.

- Employee Identification Number- Each employee is assigned a number by the company when they are first hired, and this is used for employee correspondence and record keeping.

- Paycheck Number- This is used as a reference in the event of discrepancy or to correspond with the main office about a specific pay period.

- Last 4 of Employee Social Security Number- This is used for tax purposes at the end of the year and ensures that the right employee is identified for payment.

- Pay Period Dates- This shows what date range you are being paid for based on your pay rate and how often paychecks are issued by the employer.

- Date Paycheck Will Be Released to Employee- Usually, a paycheck is released 1-2 days after the pay period ends.

- Gross Earnings With a Breakdown of Regular, Overtime, and Other Pay with the Hourly Rate of Pay- This lists the amount you were paid per type of hour worked before deductions were taken out of your paycheck.

- Deductions (Broken Down by Individual Tax)- Deductions in this example are broken down by individual tax paid but other deductions could be listed here, such as medical insurance or life insurance.

- Current Gross, Deductions, and Net Pay- This is a breakdown for this pay period only, not the entire year so far.

- Year-to-Date Gross, Deductions, and Net Pay- This encompasses all pay for the year up to this point.

It’s helpful to know that some deductions are taken from gross pay before taxes are taken out. Examples of these are medical expenses, insurance, and tax-deferred retirement contributions like a 401k. Deductions that are taken after taxes include garnishments or contributions made to charities from your paycheck. Taxes need to be paid on wages before this type of deduction is taken out. Deductions for insurance and retirement are voluntary, so you may not see these on your pay stub if you haven’t opted in.

Keep track of your employee benefits such as vacation, sick, and family leave because these are taxed differently on an employee’s books at the end of the year, and these benefits can expire if you don’t use them within a certain amount of time. It’s up to the employee to use these benefits within the allotted period of time.

Employees should not have their personal identifying information printed on their pay stubs, such as full social security number or full bank account number. If this happens to you, let your employer or Human Resources director know so it can be changed in order to protect your personal information to prevent identity theft.

An employer pays a percentage of every employee’s wages for FICA and Medicare taxes, so you may see a section on your pay stub of how much the employer has paid on your behalf. Each state has different deductions, so check with your state offices to determine what percentage you should be paying and which deductions you should be paying, or speak with your payroll or HR department about your state deductions.

All employees pay into Social Security and Medicare regardless of how much you have made year to date, but, in 2022, an employee doesn’t have to file federal income tax returns if they have made less than $12,550 if under the age of 65. Self-employment income is taxed for anything over $400 annually.

Pay stubs are a great way to understand how much you are being paid and help you to budget your money wisely. Knowing how much you are going to be paid will help you prepare your finances. And knowing how much you are paying in taxes will help you plan to file your taxes at the end of the year after you have received your end-of-the-year tax documents from your employer.

We encourage you to get to know how much you are paid regularly and monitor your pay stub for any changes or discrepancies. Remember that it’s up to the employee to update your Human Resources department of any changes in your personal situation that would change the amount of taxes you owe.