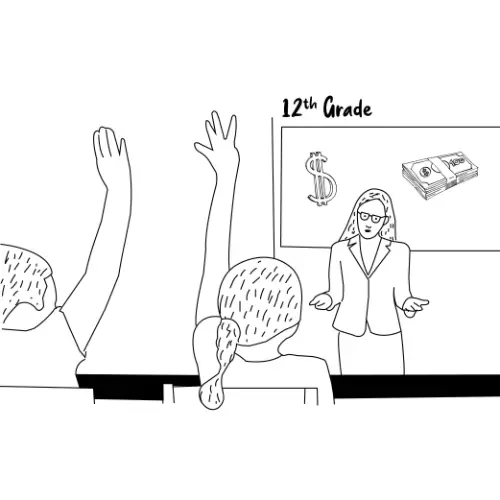

As a teacher or homeschooler of 12th-grade students, you know where they stand and if they’re ready for the wide world waiting for them. Whether heading off to college, going to trade school, or jumping straight into the employment ranks, they will need to be financially ready. You can ensure they are prepared by going over the most critical money topics, helping them have a platform to succeed. According to the National Standards for Personal Financial Education, your 12th-graders should know about specific concepts by the end of the school year. These ideas include earning income, spending, saving, investing, managing credit, and managing risk. Teachers hit these national standards in 4th and 8th grade but go much more in-depth in 12th grade, getting kids ready for real-world application. Read on to see more on these topics, some ideas on how to teach them, and a lesson plan you can incorporate with each standard.

National Standards for Personal Finance Education

Download Our Free Teachers' Cheat Sheet

Our free cheat sheet covers every learning objective in the National Standards for Personal Finance Education and the corresponding Kids' Money Lesson Plans - we cover each and every standard!

Earning Income

12th-graders are on the cusp of graduation, meaning they will be earning their own income in no time. As they move into adulthood, they need to navigate living costs and know strategies to maximize their earnings. You can explain that there is much more to income than a monthly paycheck: Students also need to consider benefits, forms of payment (commissions, salary, wages, tips, bonuses, etc.), and employer-sponsored retirement plans. You can also show them that non-tangible benefits matter as they search for jobs, such as working conditions, remote work, and career advancement potential.

Teachers may approach this topic in various ways. Students want to know details about earning income, how to make the most they can, which fields they may be interested in, and whether they should pursue higher education and training within their industry. Some methods to show them more include:

- Have students research the benefits of different jobs, both tangible and intangible. Learners can create PowerPoints or posters showing several careers, their average pay, benefits, non-economic advantages, and health and retirement packages in these professions.

- 12th-graders can look into careers more closely, focusing on unemployment rates by industry and whether or not training leads to more income.

- You can show students other ways to earn income, including dividends, investments, and gig employment. Many students can work in “side hustles” immediately after high school or even during it and would benefit from knowing the pros and cons of that work arrangement.

12th Grade Lesson Plan #1

Earning Income

Want to Get All 12th Grade Lesson Plans?

Spending

Ah, your 12th-grade students’ favorite topic: spending. They love to spend, but they may find themselves in trouble quickly after graduation without the proper guidance. You can cover the topic of budgets, show how they can adjust their plans, factor in unexpected expenses, and locate apps and online budgeting resources. Educators can explain the power of advertising and how it influences consumer spending and decision-making. By teaching kids to analyze their habits and why they buy certain products, teachers can help them look at purchases unemotionally and decide if they are rational choices. You can get into the advantages and drawbacks of renting versus buying, the purpose and methodology of donating to charity, and the importance of maintaining accurate financial records.

As students enter adulthood, they can benefit from evaluating how, where, and why they spend their money. Teachers can show them strategies and tactics to help them manage their expenses. Some of the best ways to teach students these methods are:

- Let students create budgets with real numbers. Many 12th-graders have their career choices narrowed down to a handful of options, so have them research how much their monthly paycheck may be. Using that number, learners can make a detailed budget, estimating costs and bills to see how much is available in different categories.

12th Grade Lesson Plan #2

Spending

Saving

You can explain that savings can be much more complicated than putting a chunk of cash into an account each month. Teachers may show their 12th-graders the many places they can park their money, like savings, CDs, and money market accounts. You can highlight how interest rates vary based on the holding and how these statistics impact their long and short-term goals. As learners dive into savings, they will notice how many factors, including inflation, affect their balances. A significant savings component is retirement versus non-retirement methods, and teachers can show how these versions differ but are both important.

You can approach teaching saving in multiple ways, from the economic outcomes to the psychology behind it. Much of savings comes down to personal decisions, and many activities help students understand that notion, including:

- Have students identify strategies to manage emotional and psychological obstacles to saving money. They can list the various things that may get in their way, whether trying to keep up with their peers in purchasing the latest products or worrying about social pressures.

- Look into factors that influence interest rates on saving. Guide students to understand what variables impact rates, which accounts they might put their money in, and why they would choose to make the decisions they make.

12th Grade Lesson Plan #3

Saving

12th Grade Lesson Plan #4

Investing

Managing Credit

Credit is an essential topic for these young adults, and managing it is vital to their future success. You can explain that they will notice different APRs when they shop around for credit cards, which significantly affects their money. Teachers can describe the difference between secured loans and unsecured versions, listing the pros and cons of each type. Mortgages are another crucial concept to go over, and you can show the various rates, loan types, and down-payment impacts they may face when they go house-hunting. Many of your students are college-bound, so giving them information about FAFSA and funding options for post-secondary education is paramount.

Credit is a powerful and precarious tool that adults take advantage of and also abuse. Your objective as the 12th-grade teacher is to ensure kids are fully ready for the pitfalls and potency of credit. Some activities you can have students complete are:

- Have your learners research credit cards. They can pretend to make a $1,000 purchase, comparing the APR and fees of actual cards and how those numbers impact their finances.

- Look into credit scores. Have them prepare reports that show how these scores are calculated, what individuals can do to improve them, and which factors influence the score the most. Tell them to make a plan for establishing strong credit right out of high school.

12th Grade Lesson Plan #5

Managing Credit

Managing Risk

While it sounds scary and dangerous, risk is a natural part of economic activity. You can explain that there are ways to minimize risk, like insurance. Educators can break down the types of insurance, showing students the difference between mandatory and optional versions while explaining the benefits of employer-provided products compared to private ones. Teachers may show learners that they can purchase insurance through many products, like life, health, and disability insurance.

You can find resources on the concept of risk management quickly today. Some of the ways you can approach this idea:

- Let students separate the insurance categories, listing the various situations that each covers. For example, 12th-graders can look into automobile insurance and see the multiple levels of protection, along with premiums and deductibles for each class. For home insurance, they can get into what the policy protects, including situations where homeowners may be liable for specific circumstances.

- You can also include a unit on online safety and risk management. You can have kids research the many ways that cybercriminals steal critical information and use it to con victims. Recommended strategies that help kids avoid becoming victims of identity theft, insurance fraud, and account hacking.