Imagine you’re planting a seed with your child. You’d explain how it grows into a tree, right?

Now, consider this: Isn’t retirement planning similar? It’s about sowing money today to reap benefits later.

You may think they’re too young to understand, but it’s never too early.

Let’s explore how you can break down this complex concept and make it fun for your kids to learn about planning for their golden years.

Understanding the Basics of Retirement Planning

Let’s start by understanding what retirement planning is and why it’s so important.

You see, retirement planning involves setting aside money during your working years to use when you’re no longer earning a regular income. It’s like building a safety net for your future self.

Now, you may be thinking, ‘I’m young! Why should I worry about retirement now?’

Well, the earlier you begin, the more time you have to grow your savings. Think of it as planting a seed – the sooner you plant it, the bigger and stronger the tree will be in the future.

It’s also crucial because people are living longer these days. This means that retirement could last 20 or even 30 years! If you don’t plan for this period of your life, then who will? You certainly don’t want to rely on others or face financial stress when you’re older.

To sum up, retirement planning is essential to securing your financial future. It’s one of those things that might not seem vital now, but trust me, it’ll make all the difference later on.

How to Approach the Topic With Kids

You’ve got to find the right way to introduce this topic without overwhelming them. You can’t just drop terms like 401(k), IRA, or annuity on a kid and expect them to understand. Make it relatable first; start by explaining saving for a long-term goal, like a bike or game console.

Now, think of retirement as the most extended break ever – you’re saving up so you can afford all the things you’d want to do when you don’t have your job anymore. Break down complex concepts into simple words they can grasp easily.

Use visuals if possible; kids love stories and illustrations. Draw an image showing how small savings can grow over time due to compound interest; it’s like planting a seed and watching it grow into a tree over time.

Lastly, remember that patience is key here. Explaining retirement planning to kids isn’t something done in one sitting. It’s more about planting seeds of understanding and nurturing these ideas over time.

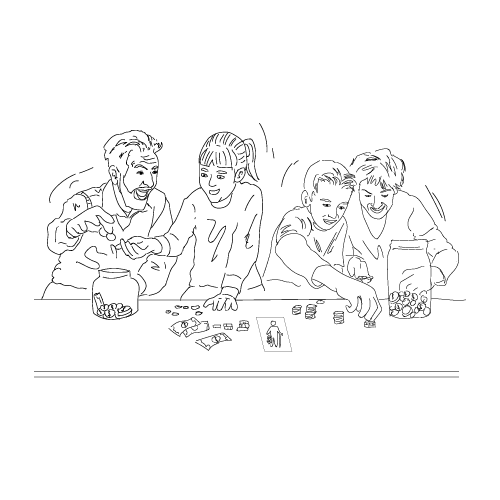

Fun Activities to Teach Kids About Retirement Savings

Incorporating fun activities into your lessons can make the topic of future savings more appealing and engaging for the little ones. It’s all about creating an environment where they can learn while having a good time.

Here are three activities that you can use to introduce them to the concept of retirement savings:

Piggy Bank Challenge:

- Have your kids save coins in a piggy bank over a certain period.

- At the end, count how much they’ve saved and discuss how saving small amounts can accumulate over time.

Savings Goals Chart:

- Help them identify something they want to buy but can’t afford right now.

- Create a chart tracking their progress as they save towards their goal.

Retirement Role Play:

- Set up a scenario where they’re retired and have savings to manage.

- Discuss what things they could do with their money, emphasizing the need for careful planning.

The Importance of Early Investment for Retirement

Starting to invest early in life can significantly increase your future financial security. By putting money away now, you’re not just saving; you’re giving your money the chance to grow.

The concept is simple: the sooner you start investing, the more time your money has to accumulate and build wealth for your retirement.

Think of it this way: if you plant a tree today, it won’t bear fruit tomorrow. It needs time to grow and mature before it can provide benefits. Your investments work the same way. They need time to mature and yield results.

You might think that you don’t have enough money to start investing or that investment is something only adults do. That’s not true! You can start with small amounts, and as you get older and earn more, you can increase your investments.

It’s also important to remember that investing isn’t about getting rich quickly. It’s about planning for long-term goals like retirement. So don’t be discouraged if you don’t see immediate returns on your investments; they’ll come with time.

Handling Kids’ Questions About Retirement Planning

When your little ones start asking about why you’re stashing money away, it’s a great opportunity to teach them about the power of long-term investment. You can explain retirement planning in terms they’ll understand and appreciate.

Here are some key points to cover:

Why Saving is Important

- Explain that money doesn’t grow on trees. We work hard for it and need to save some for later.

- Stress the importance of not spending all you have at once.

What Retirement Is

- Describe it as a long vacation after many years of work when people need enough savings to live comfortably.

How Investing Works

- Use simple examples like planting a seed and waiting for it to grow into a tree.

- Show how putting aside a small amount now can grow big over time.

Remember, you’re laying the foundation for their financial future. Make it fun, interactive, and relatable.

It’s never too early or late to start teaching kids about money management and retirement planning; they’ll thank you one day!

How to Set a Good Example

You’re not just telling your young ones about the importance of saving for the future; you’re showing them through your own actions and habits. Every time you resist an impulse buy or choose to put extra cash into savings, they notice. You’re leading by example, demonstrating that mindful spending can lead to a more secure future.

Now’s also a good time to start explaining what retirement is and why it’s crucial to plan ahead. Make it relatable – maybe compare it to a long vacation where you won’t be earning money but will still need funds for daily expenses. Be sure they understand that those funds need to be saved up over years of work.

Remember, actions speak louder than words. By actively investing in your own retirement, you’re sending a clear message: Saving isn’t just something we talk about; we do it too! Allow them to see this process – show them your investment account or the automatic deposits from your paycheck. It’s never too early to develop financial literacy skills!

An Early Start is a Good One

So, you’ve spent a lifetime teaching your kids how to tie their shoes, brush their teeth, and even drive—but explaining retirement planning? Now that’s the real kicker! Who knew you’d have to teach them about life post-paycheck while they’re still counting in piggy bank coins?

Remember, folks, it’s never too early to start the money talk!