You know what they say, give a teen $10.00, and you feed them for a day. Teach a teen to make $10.00, and they’ll go on to develop positive money management skills that will help them their whole life. As their parent or guardian, it’s up to you to teach them financial responsibility but deciding how exactly to do that isn’t always easy. Thankfully, there are effective ways to teach your teen financial responsibility. Here’s what you need to know to give your kid a leg up in money management.

Be Financially Transparent

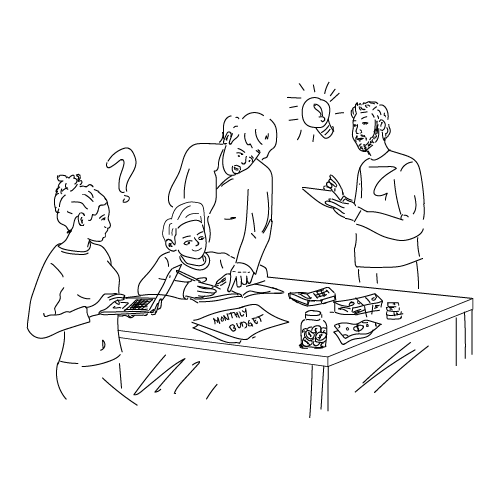

Being financially transparent means letting your kids know how much your monthly bills are and how you ensure those bills are paid. Don’t be afraid to talk about times you felt overwhelmed by your financial obligations and what you did to change the situation. Let them know how you stay on top of your finances but give them the room they need to figure out their own system.

Any financial lesson you teach a teen should be continuous, with you dispersing and revisiting bits of information over time. But to set the tone, it’s a good idea to sit your kid down and have a money conversation with them so you can learn their initial concerns and confusions regarding financial prosperity. Allow them to ask questions and be patient with them as they work through any financial lesson.

Give Them a Debit or Credit Card

Banks and credit unions offer debit cards for any teen checking account. If your teen doesn’t work, start depositing their allowance into their account and allowing them to pay specific bills. Phone bills, academic and extracurricular fees such as uniforms, trips, etc., are all great beginner fees that your teen can learn to budget around. Giving them a debit card gives them the power and responsibility to spend as they see fit.

Keep in mind that there’s a good chance they’ll make mistakes, overdraft, poorly budget, and more. And that’s ok. Plenty of adults make those same mistakes, but letting them do it in their teens gives them the chance to outgrow these habits before adulthood. Make sure you check the account statements or online banking to see how and where your teen spends.

Find out What They Want to Save Towards

A big purchase is a great motivator for any teen to get into financial readiness. Common wants include a car, trip, prom, college, and more that your kid will need to save towards. Explain to them that long-term savings goals require a long-term plan and the ability to stick to it. Work with them to make that plan come to life by figuring out how much they’ll need to save and make each month to reach their goal. You can create a handmade graph or keep it digital and track their progress through an app.

If it’s a car they’re saving towards, you can introduce the concepts of depreciation, maintenance fees, and annual costs. This helps them understand that being able to buy something doesn’t always mean you can afford it. Do they want a newer, foreign-made car? Explain the upkeep costs associated with that. Or perhaps they’re saving to buy a ticket somewhere. Let them know they’ll need extra money to travel and for emergencies.

Finding what your kids want is crucial to getting them to engage with any lesson, especially a lesson on financial security.

Teach Them About Quality of Life

Not every teen is going to respond to the idea of financial prosperity. Maybe, they don’t see the value or are preoccupied with other things. But everyone, teens or otherwise, wants a better life for themselves. If your teen is disinterested in a large savings account, ask them instead about what makes them happy and how they plan to maintain that mindset. Explain that financial freedom means more time with their friends, family, and doing what they love. Stress the importance that when they’re older, if they don’t have financial stability, they won’t be able to travel, start a business, or, if they’re more artistically inclined, have time to express their passions. Quality of life is, after all, the main reason anyone wants money. Sure, having money might not equal happiness, but it sure helps.

Teach Them The Consequences of Debt

The average American has just shy of $100,000 in debt (according to debt.org). And that number will steadily rise with inflation and other market changes. Combine that with the fact that rent is rising faster than workers’ wages, and the effects of debt become almost too apparent. Granted, not all debt is “bad debt,” as many college students are debt as an investment in their future. But a majority of debt accrued daily can be avoided with good spending habits and a well-paying job. Stress these factors to your teen and ask them to explain them back to you to ensure they understand.

If your household suffers from high debt, use the opportunity to be transparent about how it’s affected you financially. Don’t blame anyone or anything; instead, tell them the facts and how they can avoid certain pitfalls in the future.

Explain Debt to Income Ratios

A debt to income ratio, or DTI, is your monthly income vs. your monthly expenditures. For example, if you make $100.00 a month but your total bills cost $50.00 a month, you have a DTI of 50%. Banks base your lending power based, in portion, on your DTI. Let your teen know that making money is only a part of financial freedom. The other part is spending as little of it as possible while still enjoying life and managing your debt.

Chances are your teen has never thought about DTI and introducing the idea to them early helps build a money-conscious adult.

Open a Time Deposit Account

A time deposit, or CD, is a great way to introduce your teen to the idea of long-term savings. Find an account that lets you deposit whenever you want and pick a year or longer term. Not only will this help set them up for college, but it’ll show them the direct benefit of interest yields. Double parent points if you work with them to identify a long-term savings goal before opening the CD.

Apps and Tools to Help Your Teen Become Financially Responsible

Here are a few tools you can use to help reinforce your financial responsibility lessons.

Online Banking

Give your kid access to online banking if you’ve opened a teen checking account. Let them monitor their own transactions and spending habits. Plus, most online banking platforms offer a budgeting tool and long-term savings calculator that your teen can use to refine their financial goals. Plus, debit card control features give you and your child the power to block a debit card should it get misplaced. Download online banking and walk through it together to give your teen the info they’ll need.

Mint

Admittedly, Mint is more for 18+ but getting your teen started at 17 helps get them into the habit of budgeting as an adult. Mint works by linking bank accounts into one platform your teen can use to monitor their spending habits. It’s easy, efficient, and free. Check out our full app review for all the ins and outs.

Greenlight Max

Greenlight Max is the investment version of the popular banking app, Greenlight. It’s a great way to get your teen into low-stakes investments so they can learn market trends, due diligence, and other tools any investor needs to be successful.

The Bottom Line

In the end, the most important part of teaching a teen anything is patience. Let them make their own mistakes but give them the knowledge, tools, and resources needed to prevent those errors in the future. Teaching your teen financial readiness doesn’t have to be difficult. Just remember, consistency, patience, and transparency are key to getting your lesson across.