Believe it or not, there are tons of ways that you as a teenager can save more money and make the most of the money that you do have. But it takes a little work and patience to get there, especially if your income isn’t consistent. Today, we’ll cover all the ways you can keep more money in your pocket and what to do with it once you’ve got it. Ready, set, go!

Money Has Purposes (Besides Spending it Right Away)

Admittedly, spending money can be a great feeling. If you find yourself spending just for the sake of it, then just know you’re not alone. But, recognizing you have less than stellar spending habits is the first step to fixing them. Try to remember that having money doesn’t mean you have to spend it. A helpful thing to consider is that by building the habit of saving money, you’ll have more money later, and you can buy even nicer things. Putting money away for a car, college, etc., instead of spending it as soon as you get it, can give you a leg up in life.

Plus, one of the most important functions of your money is to be accessible to you in an emergency. Imagine being stranded somewhere or accidentally breaking your phone right when you and your crush start talking and not having the money to fix it. Lesson number one in saving money is actually saving it. It sounds simple but can be fairly elusive without the right mindset.

Shift Friend Hangouts to Cheap or Free Activities

Hanging out with friends is an essential part of your life, and by no means should you stop hanging out entirely. But, money varies wildly in most friend groups. You may not have the funds another friend has to go off on big expensive adventures. And that’s fine. You can suggest less costly alternatives. Here are some examples:

Instead of catching the latest movie in theaters, suggest streaming a movie you all love and making a thing of it with popcorn, lights, refreshments, etc. The total cost will be around $10 to $15 as opposed to the roughly 30 you’d spend getting a movie and popcorn.

Instead of rushing off to the latest concert, save for the artist’s newest album and have a listening party. Although it’s a listening party, you’re free to chat with your friends, which allows you to develop a deeper bond. Compared to a concert where you won’t hear a word they’re saying. Plus, most albums are free these days. Bonus points if you have a record player and snag a vinyl. Consider the cost of a concert ticket, transportation, refreshments, clothes you’d buy for the concert and probably never wear again, etc. The savings become obvious when you weigh the two. And we promise, there will always be another concert so don’t feel like you’re missing out.

Worried about an expensive date? Go for a picnic instead in a flower garden, park, riverside spot, and other natural locations that lend themselves to beauty and calmness. Or, if you’re not a picnic person, look up free events in your town like poetry readings, local live music, skate parks, and more. There’s almost always something going on outside your door that doesn’t cost a dime to check out.

Remember that any true friend will be more than willing to hang out with you regardless of the hangout spot. So, don’t empty your savings to keep up with spendier activities.

Calculate Gas Costs – Could You Walk or Bike More?

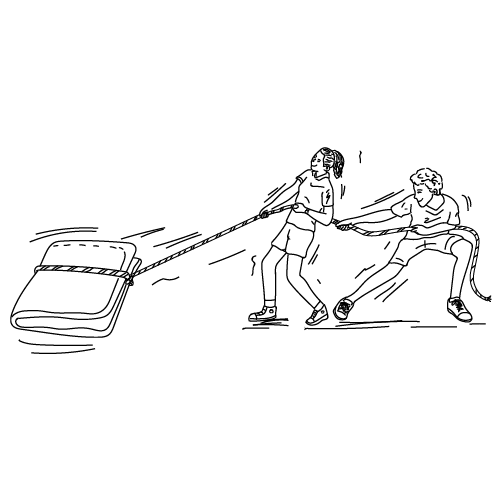

Transportation is a bill that’s easy to lose track of if you’re not careful. Bus fees, gas, repairs, and more can eat away at your savings. Thankfully, other options like biking, walking, skateboarding, etc., keep you in good shape and save you money. Weigh the costs of each given the situation. For example, do you have a job interview 30 minutes away? Take transportation so you don’t show up sweaty and messy. But if you’re hanging with a friend who lives 10 minutes away, then biking is likely a better choice.

Of course, biking, walking, etc., aren’t always an option for any given reason. A bus or subway pass is the next best thing in that scenario. You’ll be able to travel at a flat monthly rate that you can budget around.

Budget Appropriately and Keep Track of Your Expenses

Budgeting is, by its very nature, a numbers game. Calculate your monthly costs and subtract that from your monthly income. Next, figure out where you can cut costs and track your spending habits to ensure you’re sticking to the plan. As the old saying goes, it’s easy to make a budget but not so easy to stick to it. You can check your balances using online banking or a money diary.

Audit Subscriptions and Repeat Purchases

By now, you know that those 1.99 a month subscription prices add up. Movie and music streaming apps, premium versions of apps, etc., often start at one price that slowly increases throughout your subscription. This means you might budget for a subscription that you think costs 1.99 only to find out that it’s raised significantly higher. Pour over three months’ worth of your bank statements and figure out which apps are charging you and, more importantly, which of them actually add value to your life.

Do you listen to music all day? Then keep your music app but if you rarely pay attention to it, get rid of it. It’s as simple as that.

Take special note of charges you routinely make. Do you use the vending machine every day when you get to school? Are you constantly buying new DLC for a video game? Keep track of those purchases as you’ll often find you can save quite a bit of money a month by either cutting them out or getting cheaper alternatives.

Be a Budget Shopper and Look for Coupons

Budget shopping is almost an art. Every company offers sales and savings at select times per year, and you can take advantage of that. If you favorite a brand, it doesn’t hurt to subscribe to their email mailing list to get exclusive coupons and offers. For food, check out your local paper. It’s ripe with coupons and deals you can use at your preferred grocer.

Here Are Some Easy Ways to Budget Shop

If style is important to you, buy your clothes in the off-season. Sweaters are cheaper in the summer, t-shirts are cheaper in the winter, and most places have clearance sales.

For food, buy in bulk whenever possible and stick to store brand. Avoid fast food. Even the cheapest burger and fries combo is approx $15. $15 can buy pasta, eggs, bread, fruits, etc. Essentially, you’re choosing between one meal for $15 or multiple meals for $15. From the perspective of saving money, the choice is obvious.

School supplies are cheaper at the dollar store than at most other places. You can also check out local organizations that do school supply giveaways for teens in specific grades.

In the end, it’s up to you to figure out where you afford to tighten the budget. But no matter how you do it, the most important thing is sticking to it.