Exploring the complex world of personal finance, dodging the pitfalls of overspending, and resisting the lure of easy credit, you, as a teenager, might find it overwhelming. It’s a terrain filled with hidden traps that can catch you off guard, dragging you into a cycle of debt and financial instability. But what if you could identify these traps and learn how to steer clear of them? Stick around as we discuss the common money traps teenagers often fall into and practical ways to avoid them.

Understanding Teenage Money Traps

Diving headfirst into the world of money can feel like a thrilling rollercoaster ride, but it’s important to be aware of the common pitfalls that could trip you up along the way.

One such pitfall is the temptation to overspend. You might think that shiny new gadget or those trendy clothes are worth blowing your budget for, but they’re not. You’ll end up feeling the pinch later when you need cash for necessities or emergencies.

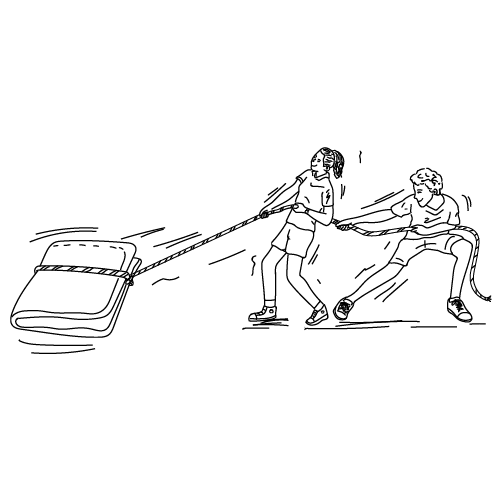

Another trap you need to be aware of is falling into debt. It’s easy to think that borrowing money to get what you want now is a good idea. But remember, debt is like a hole; the more you dig, the harder it is to climb out. It’s not just about paying back what you borrowed, but also the interest that piles up.

Lastly, don’t let money control your happiness. Yes, it can buy material things, but it can’t buy true happiness or fulfillment. Remember, money is a tool, not a goal. You’re in charge of your financial journey. So, be smart, be informed, and most of all, be mindful of these common teenage money traps.

The Lure of Impulse Buying

Let’s face it, we’ve all been sucked into the whirlwind of impulse buying at some point. It’s the siren song of the checkout line, the allure of the sale rack, the call of the buy-now button. But don’t be fooled. Impulse buying can be a dangerous pitfall, especially for you, the teens who are just starting to navigate your own financial waters.

So, how can you resist the urge? Here are three simple tips:

- Set a budget: Know exactly how much you can spend each week or month, and stick to it. This means you’ll have to make tough choices sometimes, but it’ll keep you on track.

- Wait it out: If you see something you want, don’t buy it right away. Wait a day or two. If you still want it after that time, consider if it fits into your budget.

- Ask the tough questions: Do you really need this? Is it worth the money? Asking yourself these questions can help you avoid making a purchase you’ll later regret.

Credit Card Temptations

Exploring the world of credit cards might seem like a thrilling adventure, but it’s easy to fall into the seductive trap of overspending. It’s like a magic plastic card that buys whatever your heart desires, right? Wrong. Credit isn’t free money. It’s borrowed, and you’ve got to pay it back with interest.

Think of credit cards as a test of your responsibility. Can you handle going to the mall without maxing out your limit? Can you pay off your balance each month, or will you let it pile up, accumulating interest and digging yourself into debt?

Don’t be fooled by the shiny rewards, either. You might think, ‘I’ll earn points for my spending!’ But unless you’re paying off your balance in full every month, those rewards are costing you more than they’re worth.

Peer Pressure and Finances

Now, let’s tackle another financial pitfall you might face – the pressure to keep up with your friends’ spending habits. It’s natural to want the same things your peers have, but this can lead to poor financial decisions. Here are three ways peer pressure can impact your finances:

- Excessive Spending: You might feel the need to match your friends’ spending to fit in. This can mean going out to eat more often, buying expensive clothes, or even getting the latest gadgets.

- Unnecessary Debt: If you’re using credit to keep up with the Joneses (or in your case, the Johnsons), you could end up in debt. And trust me, that’s a hole you don’t want to dig yourself into.

- Delayed Financial Goals: Every dollar you spend to match your friends is a dollar you’re not saving for your own goals. It mightn’t seem like a big deal now, but it can set you back in the long run.

Tips for Smart Money Habits

You’re aware of how peer pressure can mess with your finances, but how can you cultivate smarter money habits to protect your wallet? Let’s explore some practical strategies.

First, learn to distinguish between wants and needs. Those snazzy sneakers might look cool, but do you really need them? By prioritizing needs over wants, you’ll set the foundation for sound financial habits.

Next, practice delayed gratification. This is a fancy way of saying, ‘Hold your horses!’ Avoid impulsive spending by giving yourself a cool-off period before making a purchase.

Also, get savvy about debts. They’re like gremlins – if you don’t handle them right, they multiply! Understand the consequences of debt and avoid getting into it, especially for non-essential items.

Lastly, don’t forget to save! It’s like planting a money tree. The earlier you start, the bigger it grows. Consider setting aside a portion of your allowance or job earnings each month.

Side Step These Common Money Traps!

So, don’t let your hard-earned money burn a hole in your pocket. It’s essential to resist impulse buying, dodge credit card temptations, and stand firm against financial peer pressure.

Remember, smart money habits aren’t just about saving but also about spending wisely. Take these tips to heart, and you’ll pave the way for a secure financial future.

After all, a penny saved is a penny earned.