The round-the-clock encounter that we have as parents with money should probably make us all experts at budgeting it and teach our kids how to. But if we were to come up with a dozen excuses as to how teaching our kids isn’t as easy as it seems, we would find solace in our unified accordance.

Accepting defeat may not be the answer.

When it comes to teaching your kids how to budget money, there are a dozen reasons why it would pay off for you as the parent and your kid and their future.

Budgeting is a highly reliable way to manage money. Since your elementary or middle schooler already has the experience in their everyday dealings with money – from buying school lunches to working in the family business – they benefit greatly from having a personal budgeting plan.

In this article, we will show you how to:

- Explain to your kid the importance of creating a budget

- How you can create a budget with them

- What not to do

- How to set a good example for your kids to follow

- Kid-friendly budgeting terms/definitions

- Books to learn about teaching your kids how to budget money

At the end of the day, you will be well advised to show your kid how to strategically balance out their income and expenses and become more conscious of earning, spending, and saving their money in a responsible way.

How to Explain to Your Kids the Importance of Creating a Budget

Ever get the feeling that at times, while attempting to have significant conversations with your kid (that don’t involve scolding), they are present but not present? Or maybe they’re more of the silent type whose strength is to be all ears, but recognizes that the only time a parent utters more than three words to them is in one of two critical instances: their kid isn’t drinking enough water, or the dog needs to be taken for a walk.

Let’s face it, parents. With each new generation comes a higher record of short attention spans being broken. This reality should prompt you to take a slightly different approach to get through to them.

“What’s in it for me?”. The expression on your kids’ faces will say it all. You, as the parent, would have already asked yourself before asking them the following questions:

… Would creating a budget be a possible way of turning their dream of buying a professional drone for their Youtube channel into reality?

…Would budgeting out their finances allow them to see the potential advantage in handling unexpected situations that call for them to confidently rely on their own emergency fund?

…Could a budget plan that requires a kid to balance out their income and expense ratio prompt them to realize they’re allowed to pay themselves back more money than imagined?

Inform your kid of these key points on why creating a budget is important:

- Control your spending – Pitch the “hamster wheel” metaphor – the more money your kid spends, the more money they will continuously work towards getting back to replace the previous money spent.

- Helps you to envision/Get closer to your financial goals – Every kid has goals, big and small. Share the financial goals that you as the parent achieved by managing your own money while keeping a budget plan. Also, share how it made you feel to succeed in reaching it.

- Keeps you organized – Simply make your kid aware of the meaning of organization and how they have it in other areas of their daily life. A simple example of this is the family home – with there being a designated spot for clothes inside of a closet, fresh food inside of a fridge, and a storage area where only storage items go. Make them understand how money has a designated place, even if it’s more than one.

- Helps you prepare for emergencies – Kids at this age want to shout from the mountain tops just to prove one thing to you. It’s that they’re independent and therefore can handle a lot on their own. Capitalize on this by giving them a starting amount to contribute to their emergency fund. Give them the liberty of adding to it when necessary and take care of minor emergencies that spring up, helping to fuel their inner desire to do things on their own that just so happen to help other people involved. It’s a win-win.

Your kid may just be a little more eager and inclined than before to try to create a budget for the first time. And if you’ve gotten this far, go ahead and crack a sly smile for guiding them through the process.

How to Create a Budget with Your Kids

To get started with creating a budget with your kid, present to them a sample budget plan so that they know what to expect.

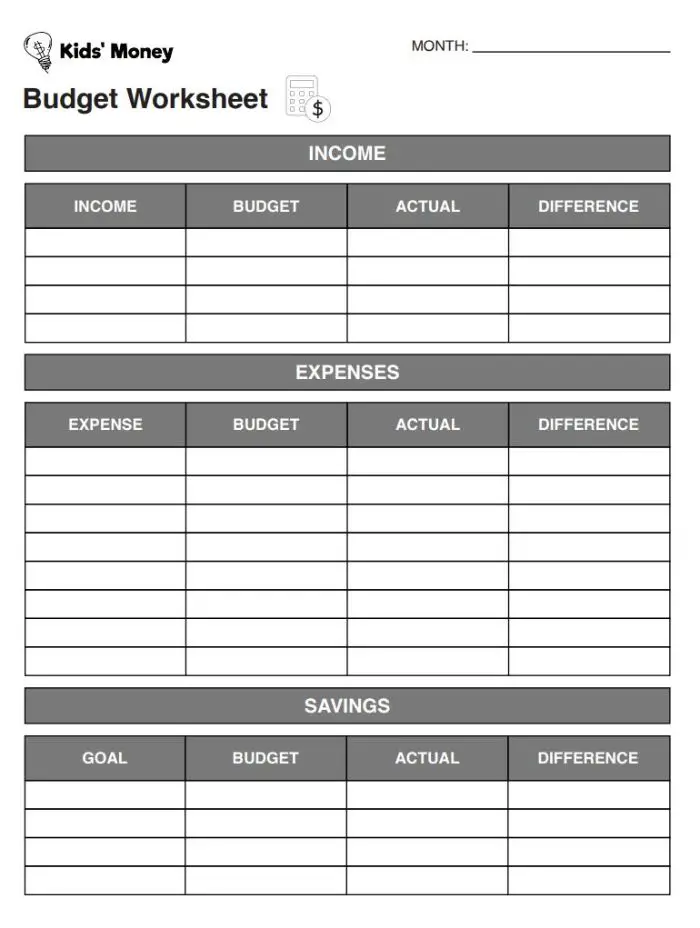

This Kids’ Money Budget Worksheet below is an excellent start for you and your kid! Use this to refer to and get a basic idea of how a budget plan looks and should work. It’ll be simple enough to break down to them and even simpler to fill out. The worksheet is available as a PDF (for printing).

Here are some other budget plan resources to choose from:

- Consumer.gov – Make A Budget Plan Printable Worksheet

- Junior Achievement – My Monthly Budget Printable

- Americanized Poor Man’s Budget Sheet

- Google Sheets Monthly Budget

What Not to Do

Parents don’t realize, but habits are contagious.

And if you as a parent have habits that seem even questionable to you, the simple solution would be to kick them. (Not to discredit our parenting skills, because we do a pretty good job within our capacity, and on top of that, we mean well… don’t we?)

Here’s what not to do to avoid inadvertently setting your kid up for financial difficulties later on in life:

- Giving off negative money vibes – when you refer to money, you want to make it look and sound good, especially when your kids are around. Thinking of money as merely a “struggle” to obtain or a deterrence due to mismanagement is likely to make your kid feel the same – that it’s challenging to get, let alone keep.

- Spending frivolously – when you get the slightest impulse to run out (or go online) to spend money, this can be a problem that threatens your financial stability and your child’s perception of how money should be spent.

- Losing track of your money – Ever forget that you left a $50 bill in your pants pocket that your kid happened to find while folding the laundry? Or getting to a store and realizing that you’ve exceeded your limit on the only credit card you brought along? Earlier in this article, we painted scenarios about safe places to designate money. Our kids benefit from knowing that being careless with money can cause you to lose it.

How to Set a Good Example for Your Kids to Follow and Learn About Budgeting Money

Juggling the daily balls of parenting life and taking care of finances is hard enough when nobody’s looking. But then reality suddenly hits, and you realize all eyes have been on you since the beginning.

As natural-born sponges, kids infamously absorb information like no other – picking up on good and bad habits. And unfortunately, parents don’t get to pick which ones get embraced and which fall by the waist side.

So how do we ensure that their chances of retaining our good, financial habits – that were learned the hard way for us – are made easy for them?

By ridding yourself of any incessant qualms or destructive relationships with money and learning how important it is to manage it for short and long-term financial stability and growth, you will be proud knowing that down the line, someone was watching.

Budgeting Definitions to Teach Your Kids

- Budget: A plan for spending and saving your money

- Balanced Budget: Total Expenses = Total Income

- Expenses: Money spent on items or services

- Income: Money that someone gets for business activity

Books for Parents to Learn About Teaching Kids to Budget Money

These books will further help guide you in advocating financially for your child by teaching them how to manage their money through budgeting. Check out our entire kids’ money book library for more great reads for you and your kids!

Get to Know: Money – With money and finance moving into a digital era, this tech-savvy book addresses how parents and educators should consider taking a new and transformative approach to teaching their kids about earning money, budgeting, bank accounts, and even cryptocurrency!

More Money, Please is a book you would happily enjoy reading with your kid. It references the author’s school-age days when he was 17-years old, having to figure out how money worked without the school system’s help.

If you are short on time and need a quick tidbit on how to teach your kid about money, give this audiobook, “Teaching Kids About Money,” a listen!