While you’re juggling your own finances, it’s easy to forget that your kids don’t naturally understand money management. But don’t worry! You’ve got the power to shape their financial future.

This article will show you how to introduce your little ones to the world of bill payments. We’ll share practical methods, emphasize the importance of punctuality, and even add a dash of fun.

Let’s start building their financial responsibility today.

Understanding the Basics of Bills

Before you can effectively teach your kids about paying bills, you’ll need to ensure they understand the basics of what a bill is. It’s not just a piece of paper or an email that arrives every month. It’s a responsibility, a promise to pay for a service or product you’ve used.

Start with simple analogies. If they borrow a toy from a friend, they’re expected to return it. Bills are the same. When you use electricity or water, you’re ‘borrowing’ it from the utility companies. The bill is your promise to ‘return’ it by paying.

Make it practical. Show them a real bill. Explain that the amount due is calculated based on how much of the service you’ve used. Point out the due date. Stress that paying on time is important to avoid late fees and maintain good credit.

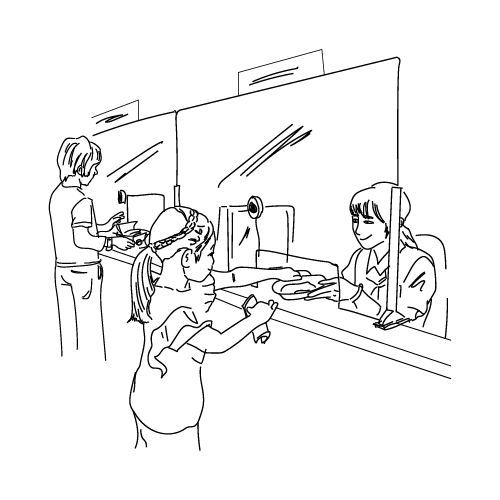

Get them engaged. Let them help you pay a bill. They can write the check or click the ‘Pay Now’ button online. This will give them a sense of the process and its importance.

Practical Methods to Teach Bill Payments

You’ll want to consider these practical methods to help your kids learn about paying bills.

Start by giving them an allowance for their little chores around the house. This way, they’ll understand that money is earned, not just given.

Next, involve them in your monthly bill-paying process. Show them how you pay for utilities, groceries, and other household expenses. This gives them a real-life example of how bill payments work.

Another effective method is to let them take responsibility for a small bill. This could be their mobile data plan or a subscription they use. They’ll learn to budget their money to ensure they can cover their bill each month.

Also, consider using visual aids like charts or graphs to show them where the money goes. This will help them understand the concepts of ‘outgoings’ and ‘income.’

Lastly, teach them about late fees and the importance of paying bills on time. Explain how late payments can affect credit scores, which they’ll need to understand as they get older.

Importance of On-Time Bill Payments

Understanding the importance of paying bills on time is crucial for your kid’s financial future, and it’s not just about avoiding late fees. It’s about instilling financial responsibility and ensuring a clean credit history. It’s about teaching them the value of money and the consequences of negligence.

Teaching your child to pay their bills on time helps them avoid:

- Unnecessary expenses: Late fees can pile up and become a substantial addition to the original bill amount.

- Credit score damage: Late payments negatively impact credit score, making it harder to get loans or credit cards in the future.

- Stress and hassle: Regularly dealing with late payments, reminders, penalties, can cause unnecessary stress.

Explain to them that everyone occasionally forgets a bill, but habitual late payments can lead to serious financial difficulties. Don’t just tell them; show them the real-world implications. Maybe let them handle a small bill and see the repercussions if it’s not paid on time. Remember, you’re teaching them to avoid penalties and take control of their finances, which is an invaluable life skill.

Family Activities to Make Bill Paying Fun

Let’s dive into five fun family activities that’ll help transform bill paying from a chore into an enjoyable learning experience for your kids.

- Bill Paying Game Night: Turn your bill paying into a fun game night. Create mock bills and a pretend bank account for each child. Let them calculate their payments, balance their accounts, and experience the satisfaction of clearing their dues.

- Family Budgeting Day: Once a month, sit down together and plan your family budget. Include your kids in discussions about where the money’s going and how you’re saving. It’ll give them a sense of responsibility and understanding.

- Shopping Challenge: Give your kids a fixed budget to buy groceries or other necessities. They’ll learn about making choices within a budget and how to prioritize needs over wants.

- Earning and Paying: Create tasks or chores around the house for which they can earn money. They’ll learn the value of money and the satisfaction of earning it themselves.

- Saving Jar Activity: Encourage your kids to save a part of their allowances in a saving jar. Teach them about the importance of saving and how it can help in paying bills.

Building Habits for Future Financial Responsibility

Before your kids reach adulthood, it’s crucial to instill habits for future financial responsibility. These habits will lay the groundwork for financial success and independence.

Start by teaching them the value of money. You can do this through various methods like giving them an allowance for chores, encouraging them to save up for something they want, or even introducing them to a child-friendly budgeting app. Remember, it’s not about the amount of money they have, but about understanding its worth.

In addition, you should teach your kids about the importance of paying bills on time. This can be done by:

- Involving them in the bill-paying process. Let them see how you handle your bills, and explain why it’s important to pay on time.

- Creating a pretend bill-paying activity. They can use play money to pay bills for their toys, developing a sense of responsibility.

- Discussing the consequences of late payments. Explain how late payments can affect their credit score and future borrowing abilities.

Build Smart Bill Paying Habits

By balancing bills, broaching basics, and building beneficial habits, you’ll bestow your brood with a bright financial future.

Make money matters meaningful and manageable with methods that meld fun and facts.

Remember, it’s never too nifty to nurture numbers know-how.

So, start today, transform bill paying from a tedious task to a thrilling triumph, and watch your little learners evolve into financially responsible adults.