Does it feel like your kid’s favorite word is ‘buy’? You’re not alone. Navigating your child’s constant desire to purchase can be overwhelming, but don’t fret!

This article will arm you with practical strategies to set financial boundaries, implement a rewarding system, and instill the value of money and savings in your little shopper.

Let’s turn this challenge into an opportunity to teach life skills!

Understanding Your Child’s Spending Desires

You’ve got to dig deep and understand why your kid’s always itching to buy something new. Is it the allure of shiny packaging, the thrill of ownership, or simple peer pressure? It’s important that you get at the root cause.

First off, realize that kids are naturally curious and impulsive. They’re drawn to novelty and they love exploring new things. So when they see something they haven’t seen before – like a cool toy or a flashy gadget – their first instinct might be to want it.

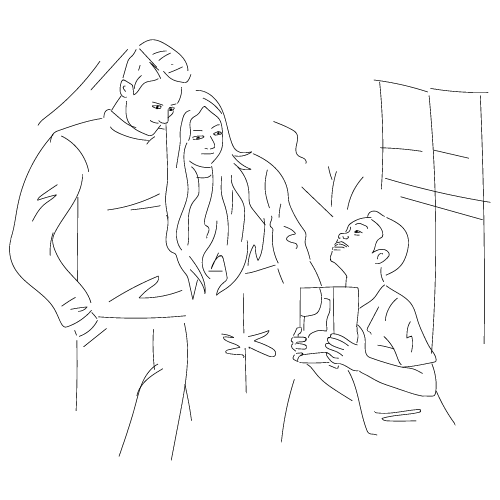

Secondly, understand that children are not immune to social pressure. If their friends have the latest toys or gadgets, they may feel left out if they don’t have them, too. This doesn’t mean your child is materialistic; it’s just part of fitting in.

Lastly, consider the influence of advertising. Advertisers know how to push kids’ buttons with catchy jingles and bright colors. If your child watches TV or uses digital devices, he’s likely being bombarded by ads for products geared toward his age group.

Setting Financial Boundaries and Expectations

Establishing clear financial boundaries and expectations is essential to curb incessant demands. This isn’t just about saying no; it’s about teaching your child the value of money.

First off, you’ve got to set a budget. Let your child understand that money doesn’t grow on trees. Explain how hard you work for every dollar and how important it is to spend wisely.

Next, involve them in some financial decisions – let them see firsthand the trade-offs involved in spending. For example, if they want a new game, show them what else that money could be used for.

Consider giving an allowance. This provides a practical way for your child to learn about managing money. They’ll quickly realize that if they blow their allowance on one thing, there won’t be anything left for other wants.

Lastly, be consistent with your rules and don’t give in easily when they beg or throw tantrums. Stand firm! If you relent too often, they’ll learn that persistence can break down boundaries – not exactly the lesson we’re aiming for!

Remember: setting financial boundaries isn’t being strict; it’s preparing your child for real life.

Implementing a Reward System

Implementing a reward system can be an effective way to instill financial responsibility. It’ll help teach the value of earning and saving money. It’s not just about giving your child what they want; it’s about teaching them the importance of hard work and patience.

Start by setting clear goals for your child. Perhaps you’d like them to finish their chores without being told or maintain good grades in school. These are things that deserve rewards. Then, establish what the rewards will be. Don’t make these too extravagant – small treats or privileges work best.

When your child accomplishes one of their goals, reward them immediately so that they associate their achievement with the reward. This immediate feedback helps reinforce positive behavior and makes them more likely to repeat it.

Remember, you’re not trying to bribe your kid into behaving well – you’re helping them understand the concept of working towards something they want. It’s crucial that you explain this principle clearly so there’s no misunderstanding.

A well-implemented reward system isn’t just beneficial in managing your child’s spending habits; it teaches vital life skills such as goal-setting, perseverance, and understanding delayed gratification.

Teaching the Value of Money and Savings

Teaching the value of money and savings isn’t just about numbers; it’s also about instilling a sense of responsibility and understanding that earning and saving is part of life. You can think of this as an essential life lesson your child needs to learn sooner rather than later.

Here are some strategies you might consider:

- Use real-life examples: Show them how you budget your own finances. This could include grocery shopping, paying bills, or saving for a family holiday.

- Start with small amounts: Give them a small allowance and let them manage it themselves. They’ll soon understand that once it’s gone, it’s gone.

- Encourage them to save: Whether it’s for something special they want or just to have some money put aside, cultivating a savings habit early on can be beneficial in the long run.

- Be patient: It’s going to take time for these lessons to sink in. Be there to guide and support them when they make mistakes.

Planting Seeds For Future Financial Success

So, when your kid’s eyes shine brighter at the sight of a new toy, don’t sweat. Firmly plant those financial boundaries, let rewards bloom from good behavior, and nurture their understanding of money’s worth.

Remember, you’re not just curbing their spending habits; you’re planting seeds for a future filled with wise financial decisions.

So, strap on your gardening gloves and prepare to cultivate a financially savvy young mind!