College is full of the 3 “ings” studying, sleeping, and budgeting. We can help with one of those things. Any college student, or anyone for that matter, can benefit from a good budget. But it’s especially crucial in college, where it’s nigh impossible to manage part-time wages and stay on top of bills if you don’t budget. Thankfully, dozens of apps on the market can help with that. If you’ve researched money management apps, you’ve probably heard of Goodbudget. If you haven’t, that’s fine too, because today we’re going to cover the ins and outs of the app. From features to benefits to ease of use to help you decide if Goodbudget is the tool for you.

Let’s get to it.

The Fast Facts

Goodbudget is simple, sometimes too simple, in terms of its functions and layout. The streamlined style is ideal for people who already know how to budget but are trying to put a new spin on it or avoid the extra services of a more complex app. Many of which come with ads. We recommend it for people whose primary focus is literally budgeting and saving money. It’s not a good fit for people interested in credit, investing, and more nuanced financial tools.

What is Goodbudget, and What Does It Do?

Goodbudget is a money management resource that makes use of Envelopes. Conceptually, Envelopes are savings accounts set aside for monthly bills and other consistent spending. For example, you might put the money for your rent into an envelope marked rent. Goodbudget, based on your input, creates Envelopes for each of your expenses so you can figure out how much money you have to save. The app itself is free, although it does have an upgraded option. It also requires you to register for the service, but there’s little to no sensitive data as Goodbudget doesn’t sync your bank account as some alternative apps will.

Goodbudget has four main screens. Here’s how they operate.

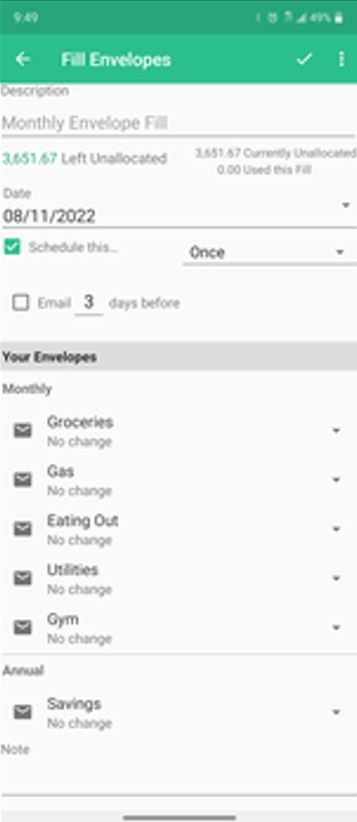

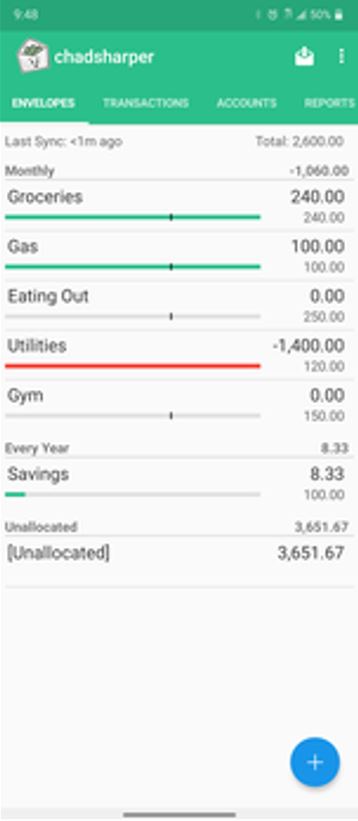

Envelopes

Envelopes, or their ideas, are the app’s core. The envelope tab lets you check the balance and expected balance in each of your savings envelopes. You can also add new ones beyond the basic Grocery, Gas, and Savings envelopes. To add new ones, you’ll need to open the tab, hit the three vertical buttons on the right-hand side, and tap edit envelopes.

Admittedly, it’s not an overly intuitive process, but it’s not too hard to figure out. For the free version, you can add up to 10 envelopes. Paid offers unlimited envelopes.

Transactions

The transaction tab lets you manage transactions by manually adding them in. It’s also great for tracking automatic transfers and, if you’re diligent enough, any subscriptions as well. You can set an email reminder for any auto pays you have.

Accounts

The accounts tab shows your total net worth based on your input. You can adjust it at any time by pressing the Account Settings button. To start, you can only have one account. The paid version of the app lets you add more. We found an easy workaround to total your account values and add the sum to the single free account. You can also add manual transactions on the accounts page.

Reports

Reports break down your spending history and use an easy-to-read bar graph to separate expenses and income. It can also split your spending report into your envelopes so you can see exactly which ones are over or underperforming. You change the date range to a broader or more specific view of your spending.

Goodbudget Features

Here are some pretty cool features of Goodbudget.

Device Customization

Goodbudget lets you hide certain bills on specific devices. For example, let’s say you want to keep an envelope out of sight and out of mind to avoid using it. You can hide the envelope on your phone app. But, if you’re like us and do a full review of your finances once a month, you’ll still have access to it except on your tablet or desktop. Remember that you can hide said envelope on your devices if you want.

Full Site

You can also access your entire account on any computer with an internet connection. That means if you don’t have access to your phone, you can still monitor your budget whenever you need it.

Budget Sync

Make savings a household affair with the budget sync option. If you and another housemate have Goodbudget, you can share your budget goals with each other to ensure you’re meeting them or make a joint budget around bills, utilities, or savings goals.

Save Location to Transaction

Goodbudget lets you set payee reminders when you’re in a designated location. This has a few uses. For example, if you frequent a business, it’s easy to keep track of your spending there. Every time you step foot into your favorite diner, Goodbudget will remind you how much you usually spend there and automatically add it to your expenses. Another example is being able to weigh the cost of similar businesses. Do you go to two different coffee shops? Chances are you spend more at one of them. With Goodbudget’s location transaction feature, you can pick the most cost-efficient businesses based on your personal data.

Personal Experience with Goodbudget

Overall, my experience with Goodbudget was pretty straightforward. I manually added a few bills and account balances to get a feel for the app. Over about a week, I checked it frequently to ensure it was tracking accordingly. However, there did seem to be an issue with adjusting account balances manually, as the app often read the input as an entirely different number. A bit of googling revealed that to be an error for which the only workaround is reentering the info.

Honestly, as far as errors in budgeting apps go, this one wasn’t that bad. The value of Goodbudget is clear and even more so, considering it’s a free app.

Pros

- Goodbudget doesn’t require you to import sensitive information

- Free

- User-friendly design

- Can make a budget as straightforward or as complex as you need.

- Really effective spin on a classic savings idea.

- Won’t bog you down with ads

Cons

- Sometimes Goodbudget is too simple as it lacks investment, retirement, credit, and other complex options.

- Have to manually import all your expenses, so the budget is only as accurate as your reporting.

- Sometimes the app glitches and changes account value.

- More convenient features like adding more than one account or more than 10 envelopes are locked behind a paywall.

Is Goodbudget Safe?

For one key reason, Goodbudget might be the safest money management app on the market. It doesn’t import your account numbers. That means if someone somehow accessed your Goodbudget app, they’d only see totals and spending habits but no sensitive information. Additionally, Goodbudget doesn’t actually transfer money for you, so they’d have no direct control over your actual funds. This key difference and the built-in protection for passwords and user names means all your info is safe within the app.

Alternatives to Goodbudget

Here are a few alternatives to Goodbudget.

YNAB

You Need a Budget is essentially as streamlined as Goodbudget because its main focus is the balance in savings. And, by default, your monthly income. YNAB has more of an Excel spreadsheet look, which may be ideal for people who like to organize hard data with no frills. Check out my entire YNAB for students review for a deeper comparison.

Mint

Mint is a budgeting tool that offers the same tools as Goodbudget but also offers investing tools, loans, credit tracking, and more. While Mint is free, it makes up for that by being ad-heavy, and sometimes it’s a little too easy to find yourself applying for a new debt consolidation loan. But for those of us who can control our scrolling finger, Mint provides almost every financial tool you need to be successful but without directly specializing in them. For example, Mint offers a pathway to investing but said pathway will take you a 3rd party option. Head over to my complete Mint review for more details.

Monarch

Monarch isn’t free, but it offers essential budgeting tools and more complex financial resources without the ad-heavy experience its alternatives have. Honestly, it’s a nifty little app that blends the best features of free and paid budgeting tools. Lucia reviewed Monarch Money, so check out that article for her experience with it.

PocketGuard

PocketGuard offers a full-service budgeting system for both its free and paid versions. And it’s top-rated for college students. After importing your account info, it’ll automatically generate your potential savings and budget while also giving you the option to track bills, credit, and transfers. Check it out!

Stash

Stash is a budgeting tool that specializes in investing. It even offers investment opportunities for minors, as long there’s an adult on the account. You can even access insurance options, track credit, and more. The catch to Stash is that it’s a subscription service. If you can’t choose between focusing on your budget and your investments, then Stash might be the option for you.

Who is Goodbudget Right For?

Goodbudget is ideal for anyone who wants to use a savings app with as little visual pollution as possible. It’s not for people hoping to break into investing or loans, but can help set you up on the right foot without the ad-heavy experience or subscription fees as the alternatives listed above. For all of its streamlined nature, Goodbudget still excels at having a user-friendly design. Ultimately, it’s best for people who want to get started with budgeting apps and those who want to focus only on budgeting.

Final Verdict

Goodbudget is perfect for anyone looking to focus strictly on budgeting. And while it can be too simple at times, it’s better than being overly complicated. Plus, anyone looking to dive into budgeting but is apprehensive about giving an app their personal information will be pleased to find that Goodbudget only requires an email to get started and doesn’t import sensitive info. When it comes to a final verdict, we prefer a pass/fail system. With that in mind, Goodbudget passes because it lives up to exactly what it’s supposed to do – help you budget!