Budgeting is an essential part of financial success. That’s especially true when you have tuition, room and board, food, etc., to pay for. Undoubtedly, it’s financially tough to be a college student. But the right budgeting app can help you make more of what you have. That said, of all the budgeting apps on the market, finding one that’s right for you can be tough. So, to save you time, I’ve personally used more than a few of them. Today, we will cover the popular iPhone budgeting app, Wally. We’re going over features, benefits, and how you can maximize your dollar. Also, Wally has a premium version. I downloaded and will be reviewing the free option.

Here’s a quick warning when it comes to downloading Wally. Wally is an iPhone-only app – despite what some Google searches may tell you. That said, there are several “knock-off” finance apps also called Wally. The real Wally app we’re reviewing today has a distinct green cursive font that spells Wally against a white background. Don’t be fooled by false apps.

Ok, let’s get into what makes Wally awesome!

Quick Summary of My Opinion and Recommendation

Wally is in-depth, to say the least. Practically every button on any screen opens a mini-menu that lets you add further detail to your budget. There are very few cons to the app that aren’t based entirely on personal preference. I’d recommend this app for intermediate budgeters instead of beginners. It’s also great for people who like to fine-tune their financial plans with as much information as possible.

What is Wally, and What Does it Do?

Wally is a budgeting tool and finance management app wrapped into one. It has a lot of nuanced features that are centered around your spending habits. It also offers a wide range of banks from which you can import your accounts. Plus, it excels in short or long-term financial planning. That means it can help you save a few bucks a day or save up for larger purchases.

The app itself has three screens. Here’s what each of them does.

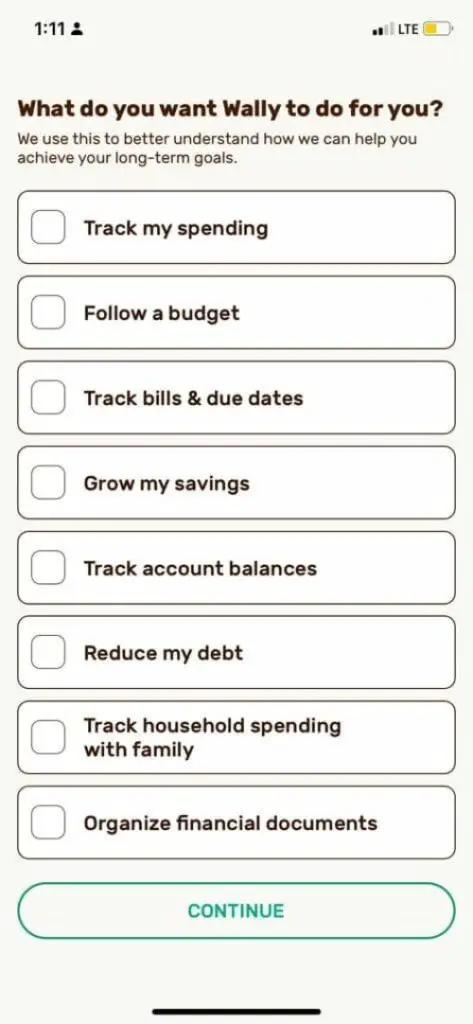

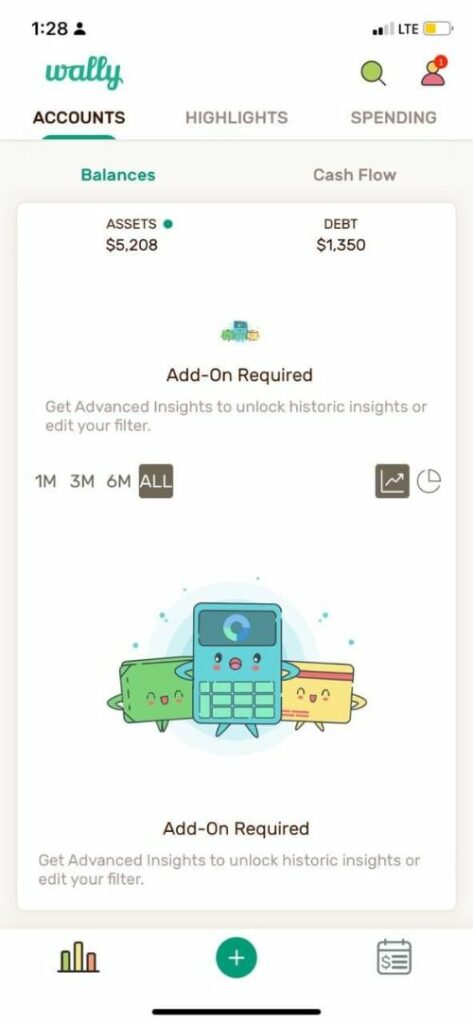

Accounts

The accounts screen shows a graph of your spending, and the free version allows you to track up to a month of spending at a time. The premium option lets you see the entire history of your in-app data. Within the accounts screen is the cash flow option, which highlights your debts and expenses. A major button within the app is the circle plus symbol in the bottom middle. You can use that button on the accounts page to add accounts, expenses, debits, etc.

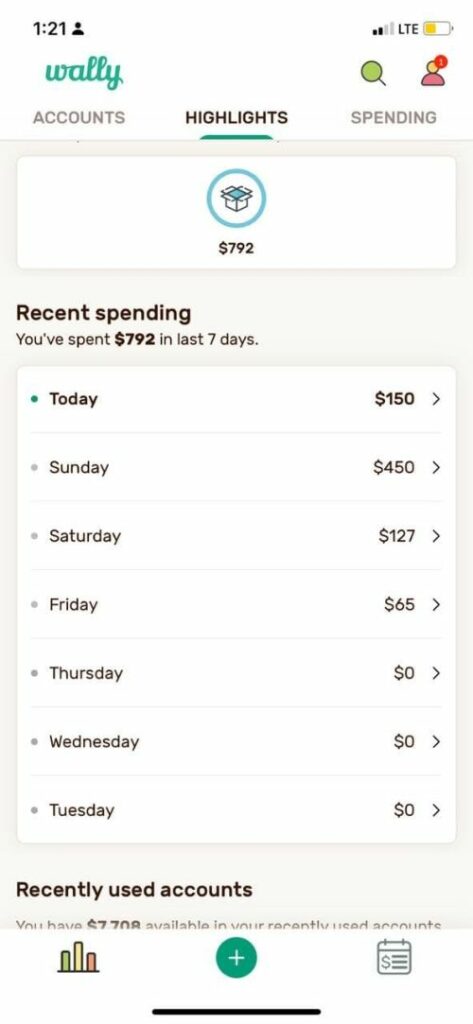

Highlights

The highlights tab is used to break down your daily and weekly spending. It has the days of the week listed and the amount spent each day. It’s a great way to ensure small purchases don’t sneak up on you.

As someone who feels better making minor charges vs. one big one, I can’t tell you how many times I’ve been shocked by the number of times I swipe my card. For people like me, the Highlights tab is really beneficial. It also breaks down exactly which accounts you’re spending from. To add a transaction to the tab, click the day of the week and add the category, payee, amount, and other important info.

Spending

The spending tab, similar to Highlights, shows you your most recent charges. But spending does it in a graph format. You can actually choose which graph style you prefer. I chose a bar graph. Tapping the box icon “unboxes” your spending so you can see an itemized list. Again, super useful for those of us who swipe a lot.

Additionally, there’s a money calendar button on the bottom of the screen you use to see another version of your spending. Tapping the funnel icon on this screen lets you choose a spending category to focus on. For example, hone in on transfers, food, and other specific bills.

Features, Fees, and Limits

Here’s the nitty gritty about Wally.

Features

Wally has more features than most budgeting apps – free or paid. Here’s what you have to look forward to.

Global Integration

Wally can import bank accounts from literally thousands of banks over dozens and dozens of countries. That includes credit accounts and loans.

Payee

When you add a transaction, you can choose the payee. And by that, I mean the actual payee from a long list of stores in your local area based on GPS data. The app will automatically assign the charge to the correct category, and you’ll be able to monitor which businesses get the most of your money.

Categories

Categories are an important part of any budget. Knowing you spent $100 isn’t as valuable as understanding why and where. To that effect, Wally has over a dozen categories, including nightlife, spiritual, sports, and of course, all of the essential categories like rent, insurance, etc.

Library

The library function is tucked in the profile tab. To reach it, click the silhouette and then look for the library. The section allows you to add reminders, lists, docs, notes, and comments.

Group

The group feature is basically what it sounds like. Link up with your friends and split vacations, charges, etc.

Wally Gold

I didn’t get the chance to explore Wally Gold, mainly because if I paid for every app I reviewed, that’d be bad budgeting. But it does have a host of benefits, including joint account management, more nuanced control over budgets, and global currency tracking.

Fees

Wally can be used for free indefinitely. But for those who want to upgrade, there are three options. Monthly at $8.99, annual at $39.99, or a once-in-a-lifetime charge of $99.99

Limits

Wally doesn’t have any true limitations as a budgeting app. It’s easy to see why it makes many best-of lists for software in its niche. It doesn’t lend itself to investing and offers no direct path to lenders. However, the latter isn’t necessarily a bad thing.

My Experience

I was pleasantly surprised to find that Wally lived up to the hype. It has everything you need to set various budgets and then some. I opted to skip importing my accounts, but I went as far as possible before confirming. Wally uses Plaid to connect accounts. From there, I added a bunch of bills and watched as they popped on the graph. I specifically focused on the weekly spending options as that’s typically where I have the most room to save. I tracked my spending and even messed around in the library section. It was super easy to get started, and I never felt like there was a feature I was missing out on – even with the free version.

Here’s me, just getting started with Wally.

Here’s me checking out the data.

The weekly expenses tracker is my favorite. And not something I knew I needed.

Major Pros and Cons

Here is the need to know about Wally.

Pros

- Ad Free

- The free version has everything you need.

- Allows for a highly detailed budget.

- Global integration for banks and payees.

- Doesn’t sell your info.

Cons

- Has a fee. (Although, it’s well worth it.)

- Doesn’t offer investments.

Is Wally Safe?

Wally is incredibly safe and offers security equal to any given bank. Further research I’ve done suggests there’s never been any notable data leak or fraud associated with the app. And the app itself doesn’t store any visible information. This means importing an account doesn’t mean the account number is readily accessible via the app. All in all, I had no worries about my privacy with Wally.

Alternatives to Wally

It’s ok if Wally isn’t for you. Try these other budgeting apps instead!

YNAB

You Need a Budget is an app that lends itself to beginner budgeters. In addition to all of the essentials, it has a comprehensive resource page that teaches the finer points of finance. And the company has a background as a YouTube channel centered around money management. YNAB is free and offers the perfect blend of minimalism and modern functions.

EveryDollar

EveryDollar is designed to make as airtight a budget as possible. It helps you assign every dollar in your budget so you can see exactly how much you stand to save. It offers a lot in the way of budgeting options and nuance. Check it out!

Fudget

Fudget is a budgeting app with a minimalist design. It’s a great alternative to Wally if you’re overstimulated easily or want to focus on the big picture in terms of budgeting. It’s free but has a premium version available. While the upgrade isn’t needed, it offers quality-of-life options. Check out Fudget if you’re looking for a simpler approach to budgeting.

Who Is Wally Right For?

Wally is perfect for data-driven people. It gives you critical insights into spending, has multiple ways of displaying info, and encourages long-term tracking. Beginner budgeters can definitely benefit from the app. But I’d argue it’s best for intermediate to expert budgeters looking for an all-in-one option. Plus, it’s excellent for country-hopping travelers. Are you spending a summer abroad? Taking an internship in a faraway land? Check out Wally.

Final Verdict

Wally is a great app. And it has a lot to offer. On a pass/fail basis, Wally passes due to its ease of use, customer-centric features, and global footprint. That said, if Wally doesn’t quite fit what you’re looking for, then check out the alternatives listed in this article. Or find a non-app method. As long as you see the value of budgeting and work towards it, you’re on the right path. Head to our college student’s guide to budgeting for more advice.