Using technology to teach kids the basics of financial literacy is a great way to prepare children for the future. A popular app among families these days is BusyKid, which allows parents to give kids a taste of real-world money management. After a few friends mentioned it, I decided to look into BusyKid to see if it was a good option for our family.

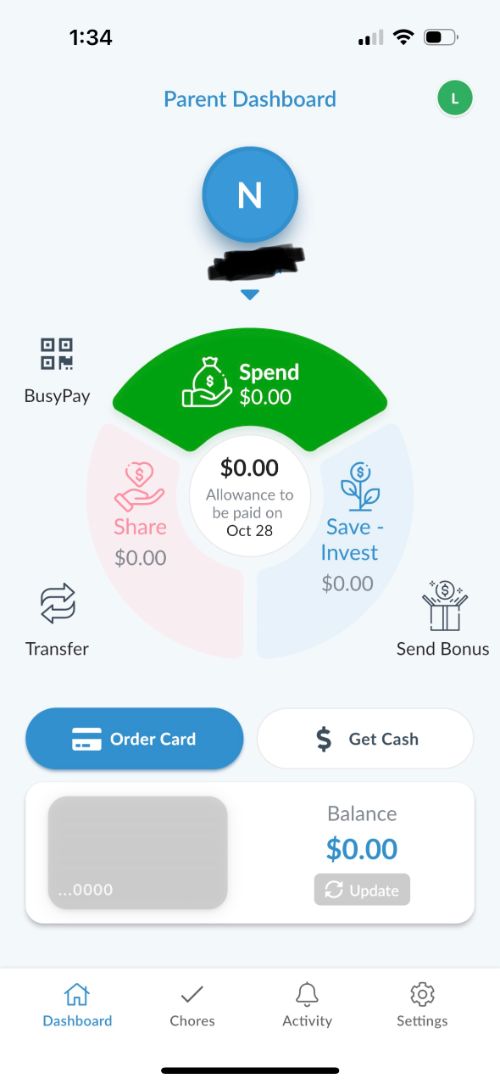

The idea is simple – you assign chores and allowances, kids receive money, and their funds are divided into three buckets: Save, Spend, and Share. Right away, I knew I wasn’t a fan of linking home responsibilities to payments. At the same time, I loved this digital spin on the three-jar system and how it includes giving as part of a child’s financial education. So, I decided to try BusyKid, and here’s a recap of how it went.

BusyKid in a Nutshell

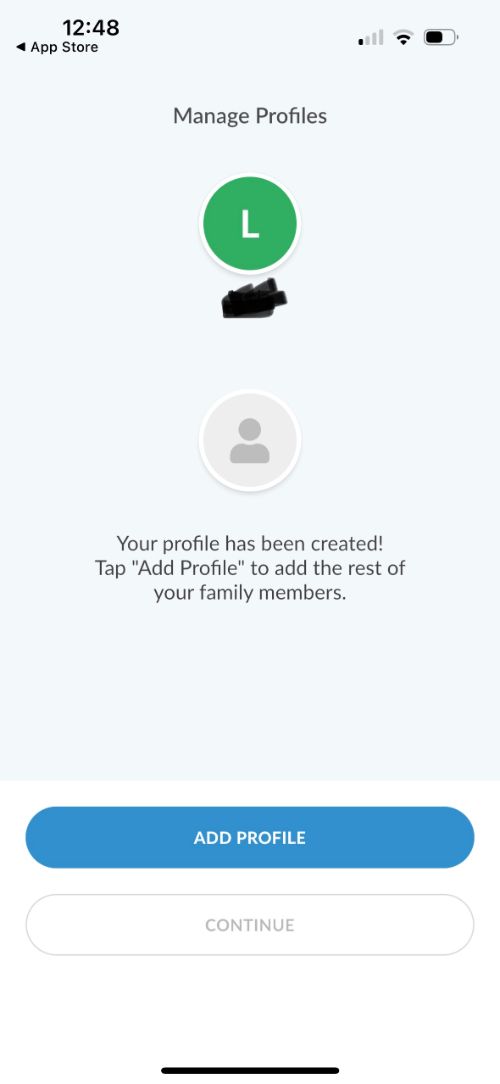

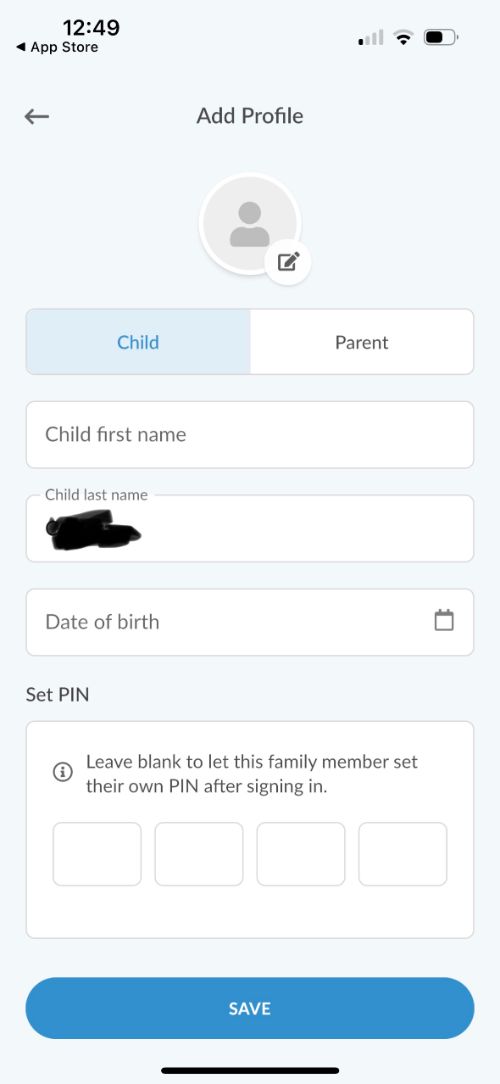

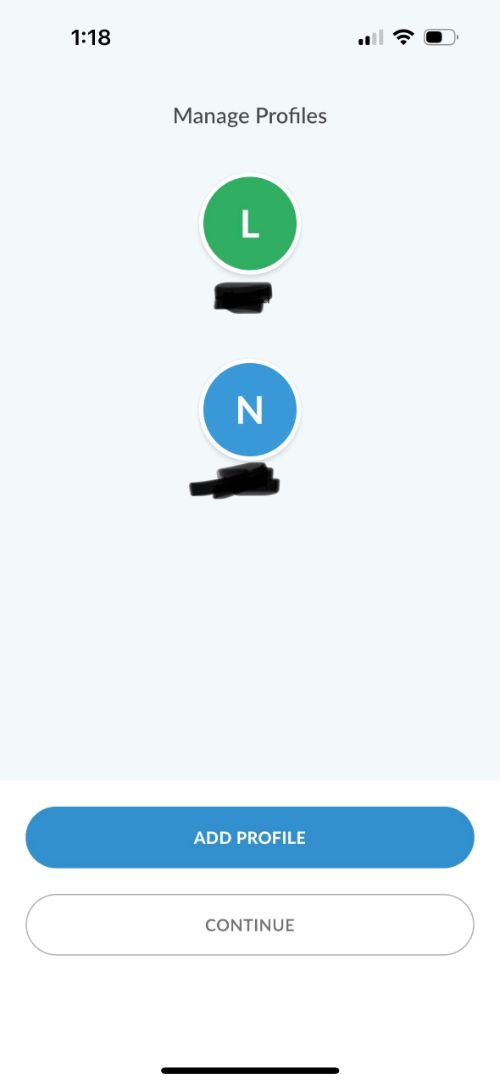

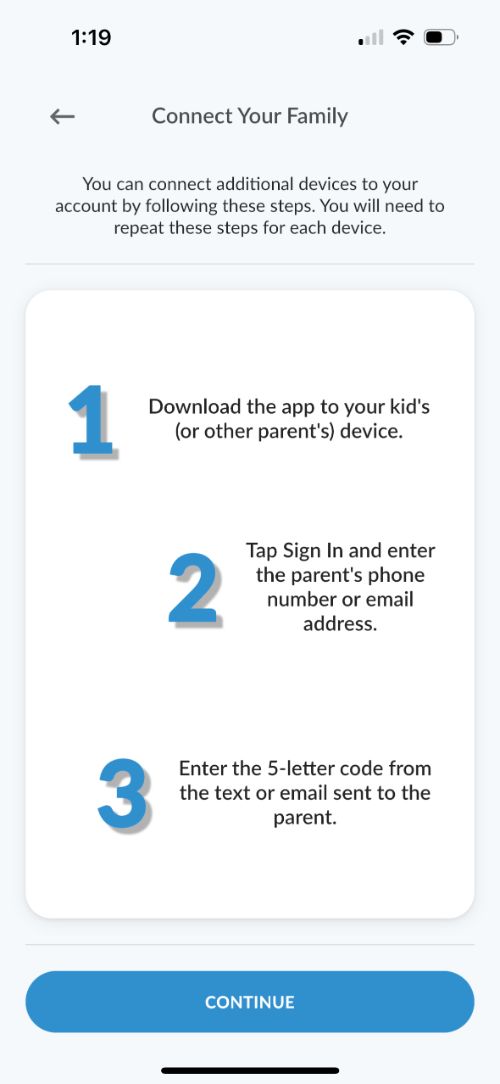

BusyKid is an easy-to-use app plus debit card combo that lets parents assign chores and pay their kids for performing those tasks. It offers the ability to create multiple app profiles so you can have one for yourself, another for your partner, and one for up to five children using the app. And the debit card works just like your bank’s card, making it easy to shop in person or online.

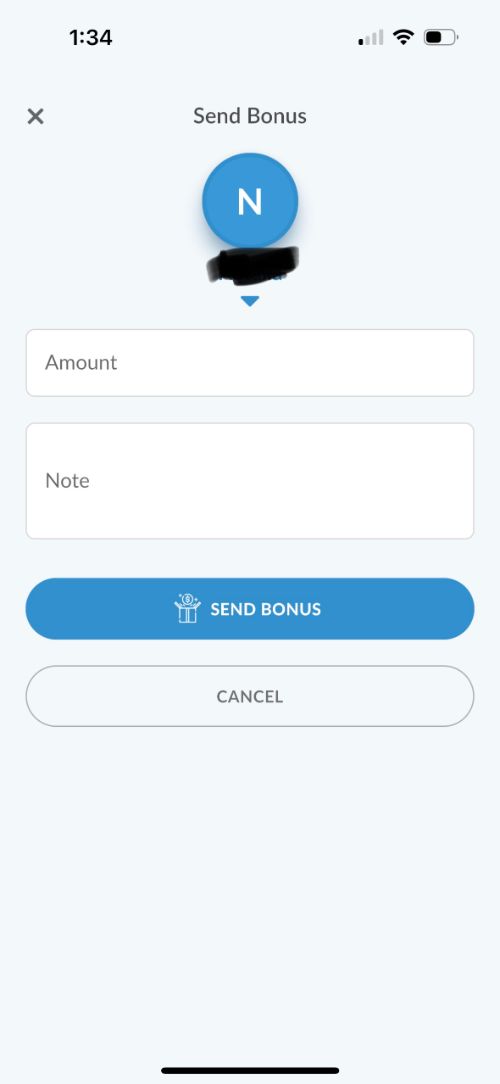

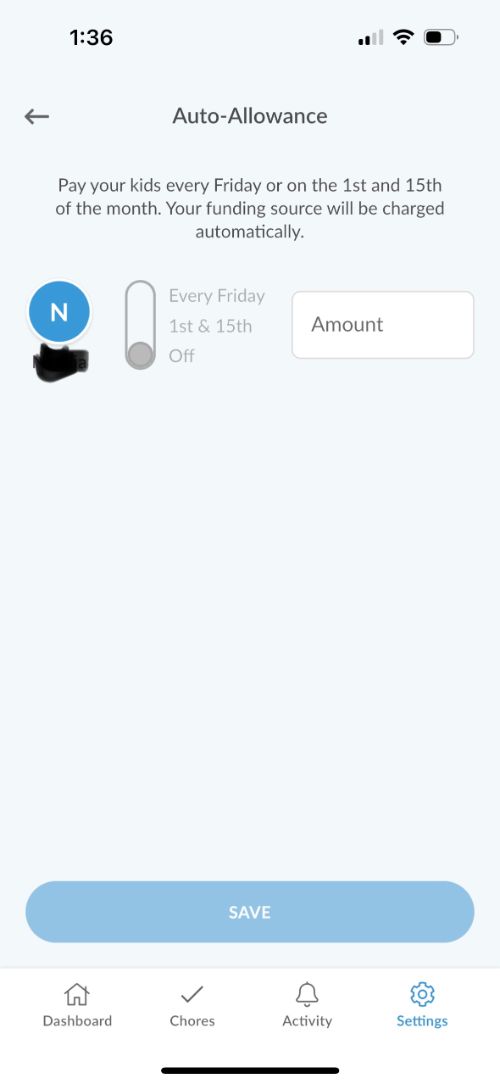

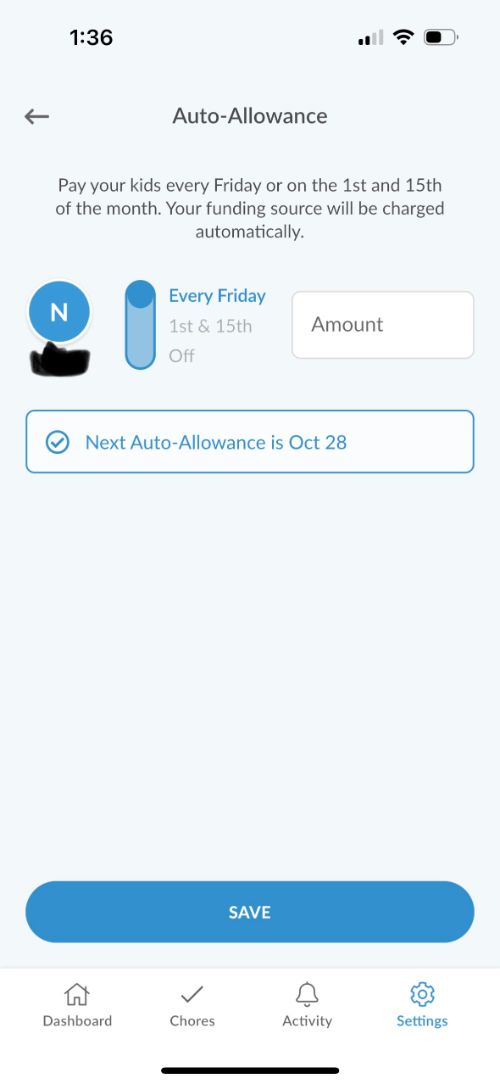

After downloading the BusyKid app and playing around with it, I quickly realized that there’s an option to set up a recurring allowance independent of chores. There’s also the option to give your child a bonus and match their savings.

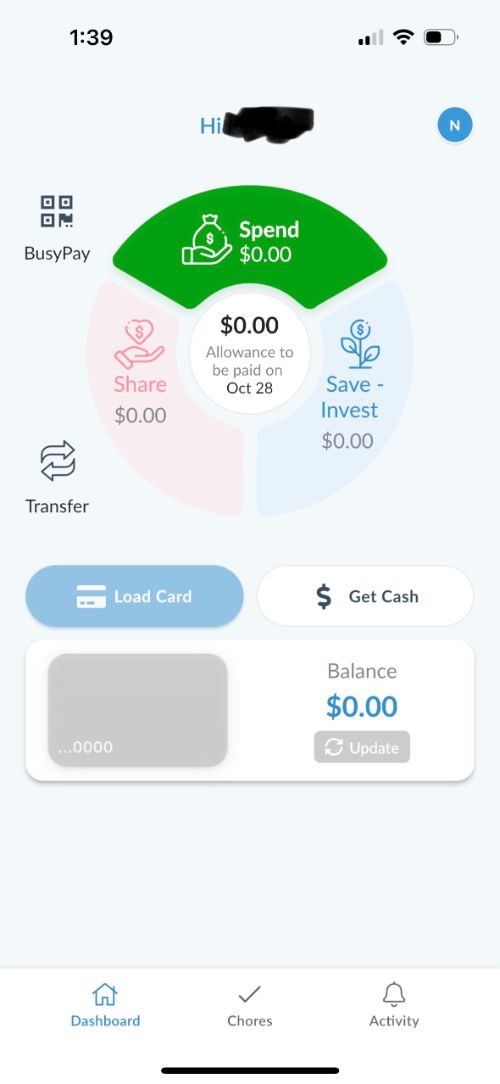

On the kids’ side, the app allows children to track their earnings and manage their money. It features three buckets where kids or parents can allocate money between savings, spending, and sharing. With this straightforward tool, children begin to learn about budgeting and financial decision-making.

If I had to describe the app to someone who’s never used it, I’d say it’s:

- Intuitive

- Practical

- Affordable

BusyKid Card and App Details

BusyKid is a chore and allowance app that includes a children’s debit card for kids to learn the basics of earning, spending, saving, and sharing money. It allows parents to incentivize kids to do their work at home while allowing parents to track their children’s expenses.

How it Works

Designed for kids ages five to 16, BusyKid is a great entry-level money management app that keeps money matters simple. For parents who like to tie their kids’ allowances to chores, it offers the option to assign tasks and pay your children once those jobs are completed. For those who prefer an ongoing allowance system, BusyKid lets you set up a recurring payment that withdraws funds from your bank account into your child’s BusyKid account.

Once kids receive the money, it gets divided into three buckets according to the allocation you and your child set up. In other words, you and your child can have a conversation to decide what percentage of their income goes toward spending money, how much goes to their savings fund, and how much goes to sharing.

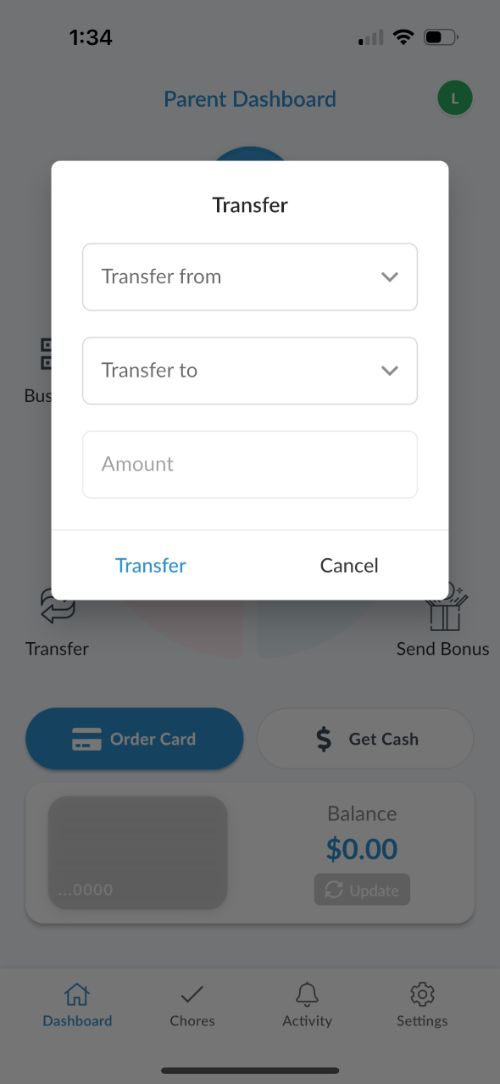

This is a great way to spark conversations about budgeting and making charity part of your financial habits. Of course, you can always transfer funds from one bucket to another as needed.

Features

BusyKid is not one of those apps full of bells and whistles – and, to be honest, I liked that. In my opinion, there’s no need to make money matters complicated for kids. It should feel manageable and fun.

Having said that, the app does have some features that are unique and handy.

Bucket System

My favorite feature by far was the bucket system. By deciding on and setting up an allocation, this feature allows your child to learn the power of automation. Plus, it helps kids stay disciplined by putting part of their money straight into savings.

Sharing

I appreciate how BusyKid makes sharing part of children’s financial education. The platform includes a wide selection of charities for your child to contribute to directly from the app. In addition, your child can search for other causes and link them to the app for seamless donations. But, if you prefer a more hands-on giving experience, you can always transfer your sharing funds to spending and use the debit card to buy items for those in need.

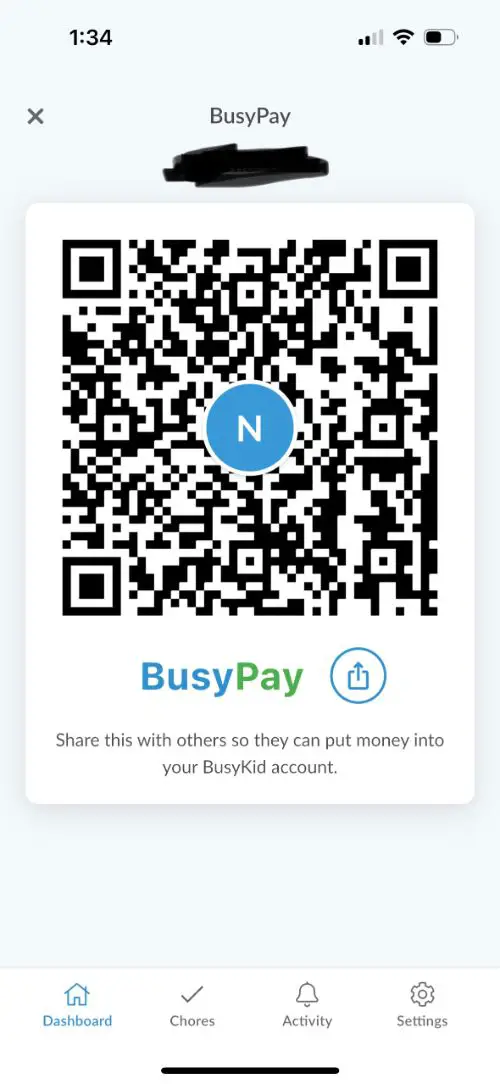

BusyPay

Another fun feature of the BusyKid app is BusyPay, a QR code you can share with others for easy payments or contributions to your child’s account. This payment feature is a big plus for someone with an entrepreneurial child like mine. It allows her pet-sitting clients to pay her seamlessly, so the money never touches my hands, and they can rest assured that she receives every penny she earns.

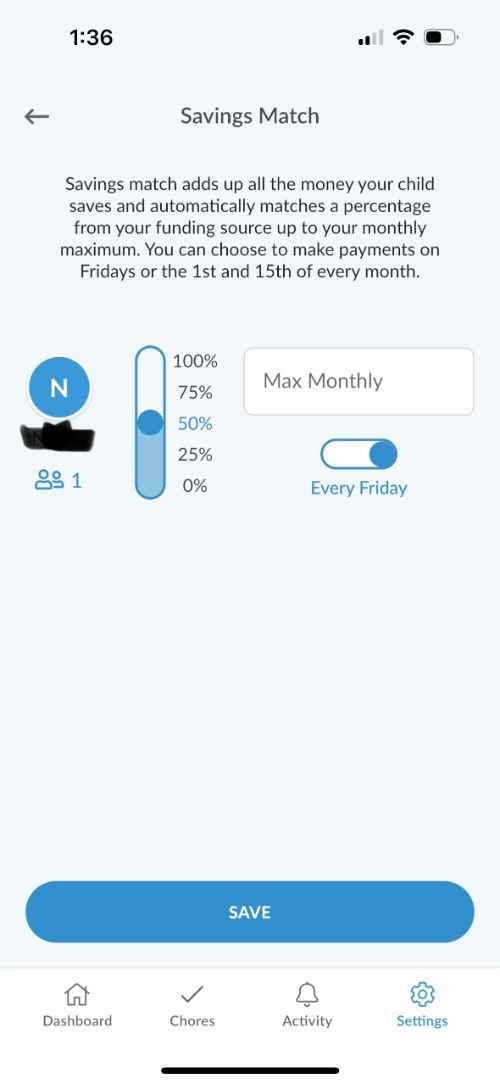

Savings Match

If you want to encourage your little one to save, consider the Savings Match feature. It allows you to choose what percentage of your child’s savings you match and how often. Plus, you can set a maximum monthly matching amount to ensure your saver doesn’t drain your bank account!

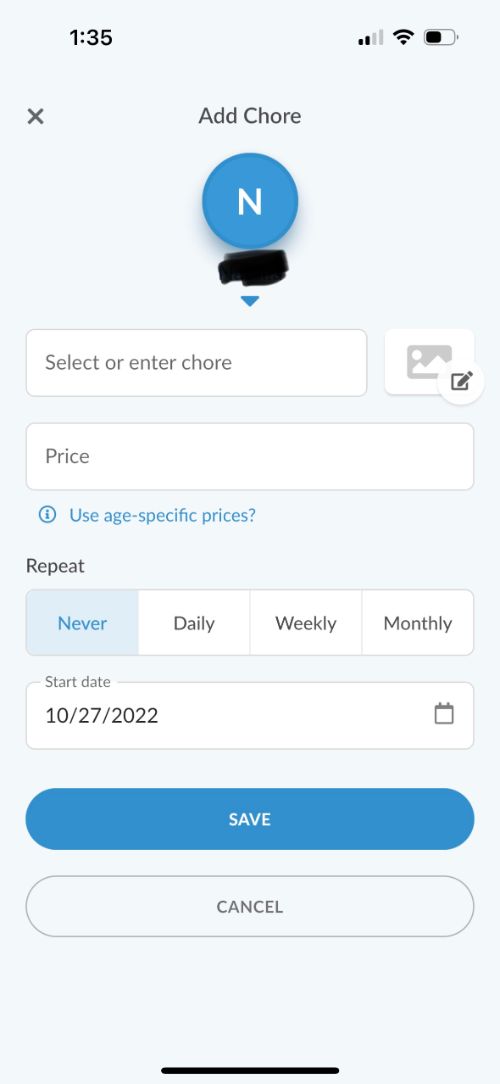

Chores

For parents who pay children for housework and for kids who need reminders, BusyKid can serve as a digital chore chart that lets you keep track of your child’s progress and encourages them to get work done. Could this finally put an end to the nagging, whining, and arguing over chores?

Investing

Full transparency: I didn’t try the BusyKid investing feature because my child already has an investment account elsewhere. However, I think it’s worth mentioning because, for just a minimum $10 investment, your child can start their investing journey within the BusyKid platform. According to the website, there are no commissions for placing trades, and it could be a good way to introduce your child to the stock market – as long as you’re there to guide them and invest responsibly.

Fees

Here’s a breakdown of the costs associated with your BusyKid account:

- Subscription fee: 30-day free trial and $4/month (billed annually) afterward. Up to 5 children.

- Card replacement fee: $5.00 each time

- BusyPay transfer: $1.00/transaction

- Declined purchases: $0.50 each

- Foreign exchange fee: 3% of each transaction

- International purchases: $2.50/transaction

With your annual fee, you also get the following unlimited transactions at no cost:

- Loading money into your child’s account

- Domestic debit card transactions

Our Family’s Experience with BusyKid

Overall, our family had a good experience with BusyKid, and my nine-year-old enjoyed using the app and the card. It was a good choice for her age group, though I do think that older children would benefit from a more robust experience. Personally, I feel that BusyKid is appropriate for children between the ages of six and twelve.

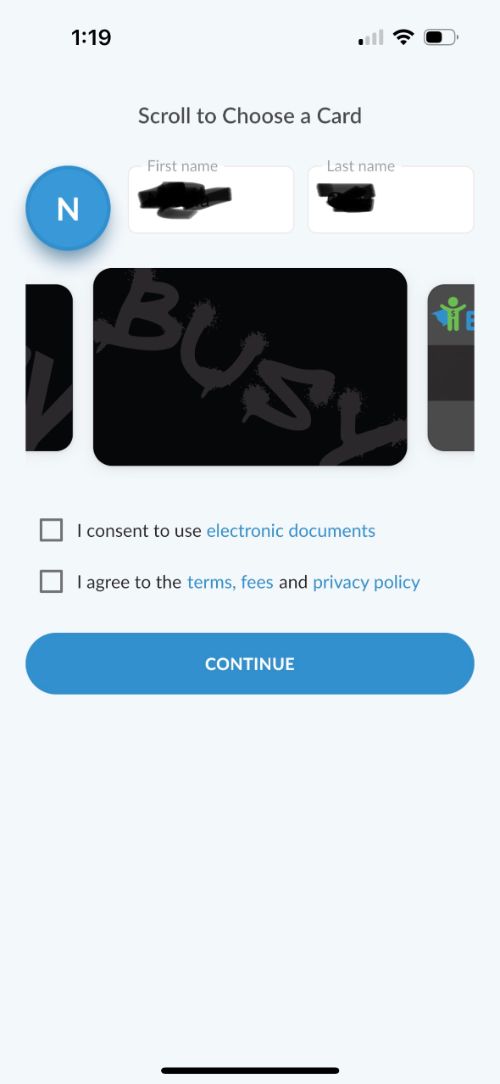

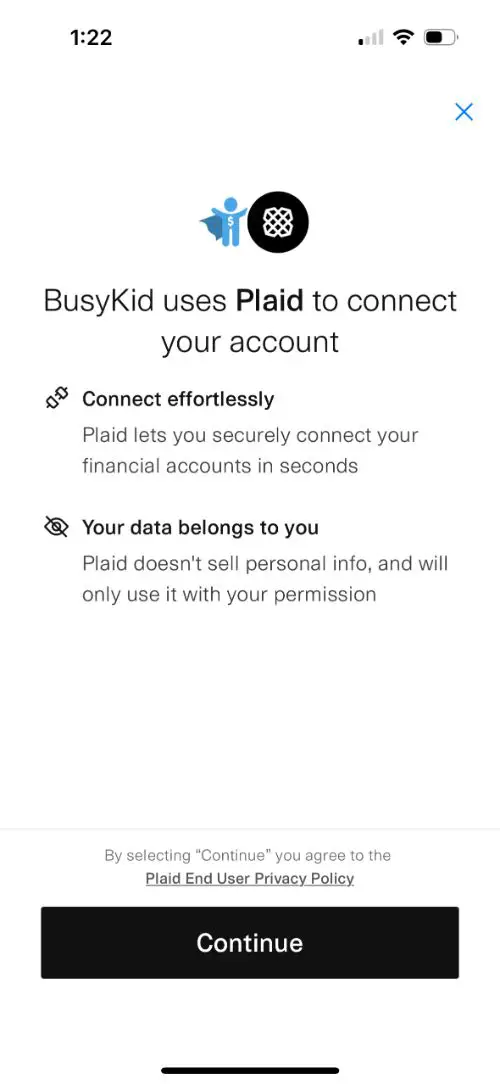

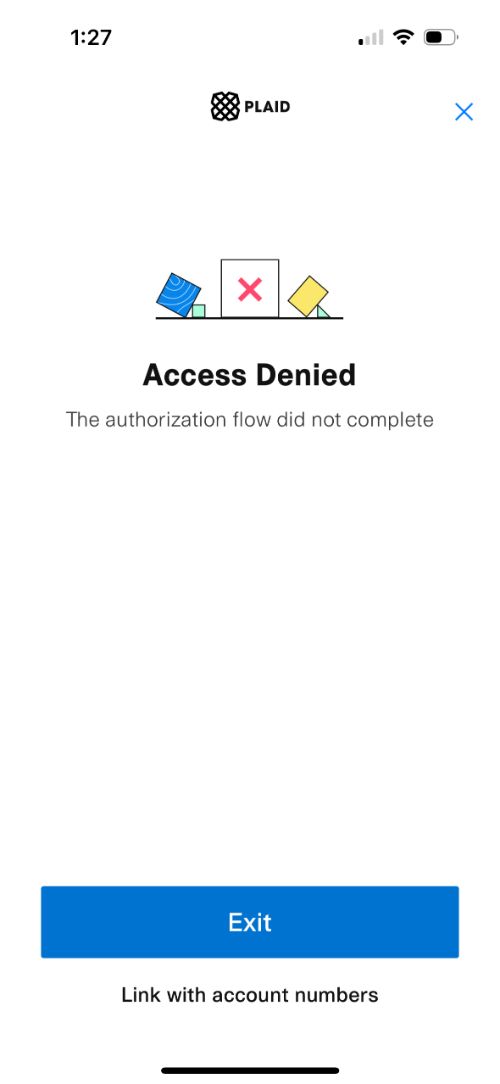

The setup was not as seamless as I would’ve liked. While it was easy to enter all of our basic information, and I didn’t need to provide too much information, linking the app to my bank account was challenging. It took several tries, and even after downloading a different browser, I kept getting error messages. Update: BusyKid recently released some upgrades that improved this experience since my initial sign-up, though, so it should be a lot better for you!

I had almost given up when I decided to enter the app one more time and see which features I could explore without the paid membership. As I tapped on one of the icons, the app gave me the option to pay my fee, and it worked! From there on, the app ran seamlessly on both profiles.

Pros and Cons of BusyKid

There were things that I really liked about BusyKid and that I hadn’t seen on other money management apps for kids. And, as with everything, there were things that I felt the app could do better.

Pros

- Buckets help kids meet their financial goals and introduce them to budgeting

- The app offers kids the opportunity to make their own purchases

- It’s a good way for kids to learn about earning money

- Great option for families with up to 5 kids

- Easy account-opening process

- No minimum to open an account

- Free trial

Cons

- Glitchy experience linking my bank account (they’ve since upgraded this experience)

- No in-app financial literacy content for kids (on their website, not in-app)

Is BusyKid Safe?

As a parent, BusyKid allows you to monitor and track your child’s spending habits. You can also control the transfers of money into your child’s account and change them at any time.

The BusyKid SpendCard works in all establishments where Visa debit cards are accepted, including online purchases. It counts with FDIC insurance up to $250,000 and a Zero Liability Policy if any unauthorized charges take place when your child’s card is lost or stolen.

BusyKid vs. Other Kids’ Debit Cards

BusyKid is an affordable solution to introduce your child to debit cards and money management. Its monthly service fee is lower than other apps, but it also has fewer features than others and doesn’t include any educational content.

I would say that compared to other kids’ debit cards and apps, BusyKid focuses more on the basics of budgeting and chore management. Here are some others that I’ve tested.

- Greenlight debit card review

- GoHenry review

- FamZoo review

- Chase First Banking review

- Copper Banking review

- Step Banking review

BusyKid, the Debit Card for Busy Bees

If your child runs their own business or stays busy with household chores as a source of income, BusyKid is the app for them. It’s a great choice for entrepreneurial kids up to age 12 looking for a way to get paid and spend their money wisely while working toward their savings goals and sharing with those in need.

The key to finding the right money management app is to explore the options with your child and get the money conversation started. This will help you learn more about their goals and how you can provide the tools to kick off their financial journey. I didn’t name BusyKid one of my top debit cards for kids, but it is still a good app for some people.

Editorial Updates

Since my initial review of BusyKid in 2022, they’ve updated their product and service quite a bit. I’ve made the following changes to my review:

- BusyKid used to not offer a free trial, which was one of the cons in my experience. They now offer a free trial, which is great for everyone!

- I had a pretty glitchy experience linking my bank account in the BusyKid app. The BusyKid team has since upgraded this experience.

- They gave the app a recent redesign, which I’m in the process of grabbing new screenshots for to paste below.

Screenshots From My Experience