I have two daughters, one is nine and the other is 16. Because there’s a big age gap between them, their spending habits are pretty different. One loves to splurge on crafting kits, while the other lives for lunch out with friends. And when it comes to financial goals, my youngest is focused on building her investment account, while the oldest stashes all her spare cash for college.

But despite the age difference, what they both have in common is that they love feeling independent. And having an allowance that each of my girls can manage is a great way for them to exercise this sense of independence.

The problem was that I didn’t have time to stop by the ATM once a week to withdraw cash – plus, these days, kids prefer the convenience of a debit card, and it’s a much easier way for busy parents to keep an eye on their children’s expenses. So, we decided to try Greenlight, and this is the down low on how that went.

Cliff’s Notes

If you’ve only got a minute, here’s a quick overview of Greenlight based on our experience as a family.

As a parent, I loved the quick setup and intuitive app that made it easy for me to get everything in place! I also appreciated the convenience of managing both allowances in one single app and being able to establish weekly transfers to each of their debit cards.

What’s even better is that both of my daughters also had a great experience with Greenlight. They found it easy to use and appropriate for their needs, so there were no complaints on their end.

Overall, I’d say this is a great financial solution for parents with multiple children looking for a one-stop shop that allows them to manage allowances and chores while providing tools to enhance their kids’ financial education.

How Greenlight Works

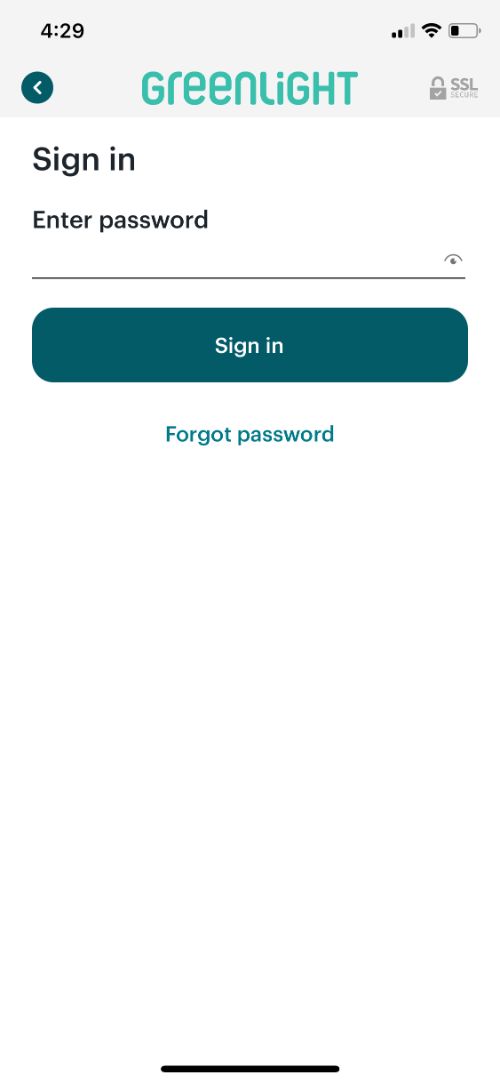

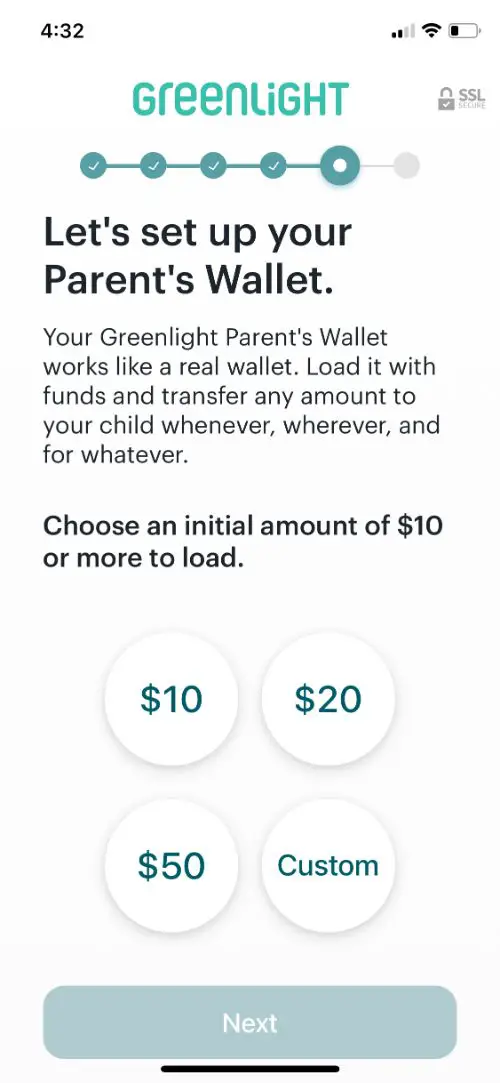

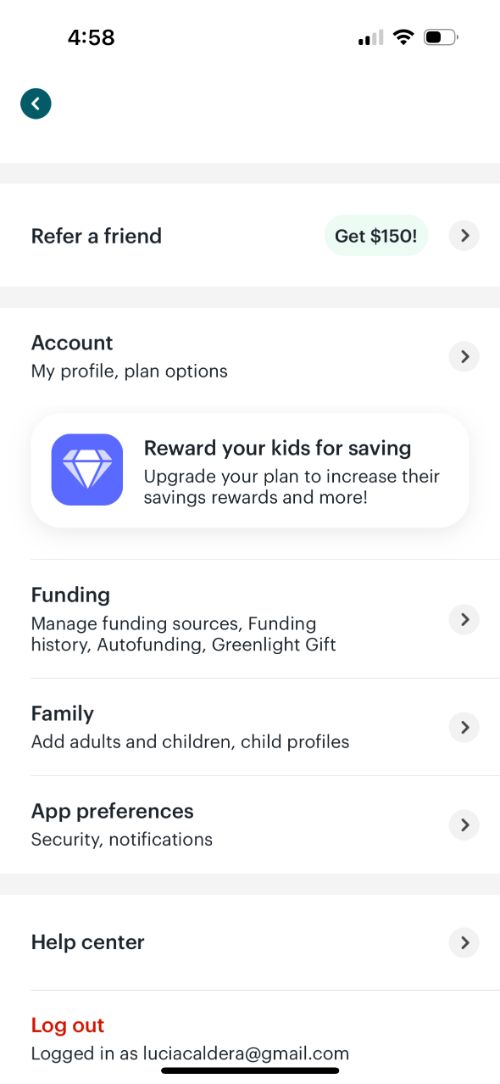

With Greenlight, allowance management and financial education are pretty simple. To get started, you download the app and create an account. In my case, it only took a few minutes to do this.

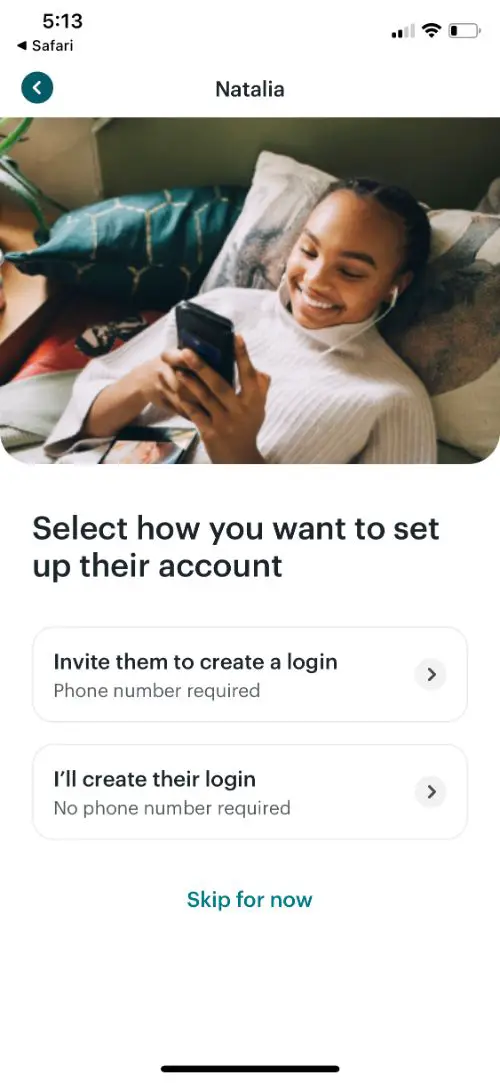

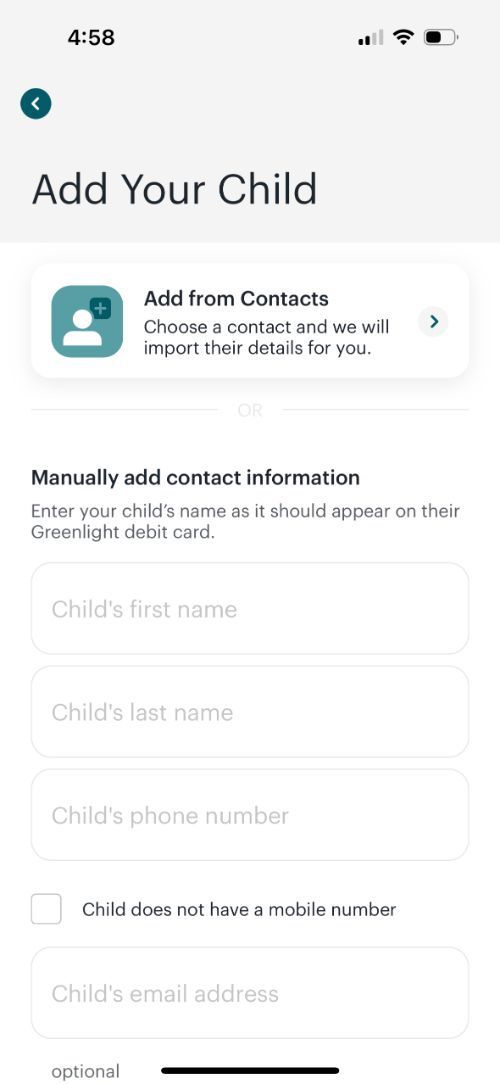

Once you’ve entered your kids’ information, you can send them invites to join on their own devices. But if your child doesn’t have their own phone or tablet, you can also create a separate login for them to use on your phone. This way, they can log into their account and access all of the available content to learn more about money management.

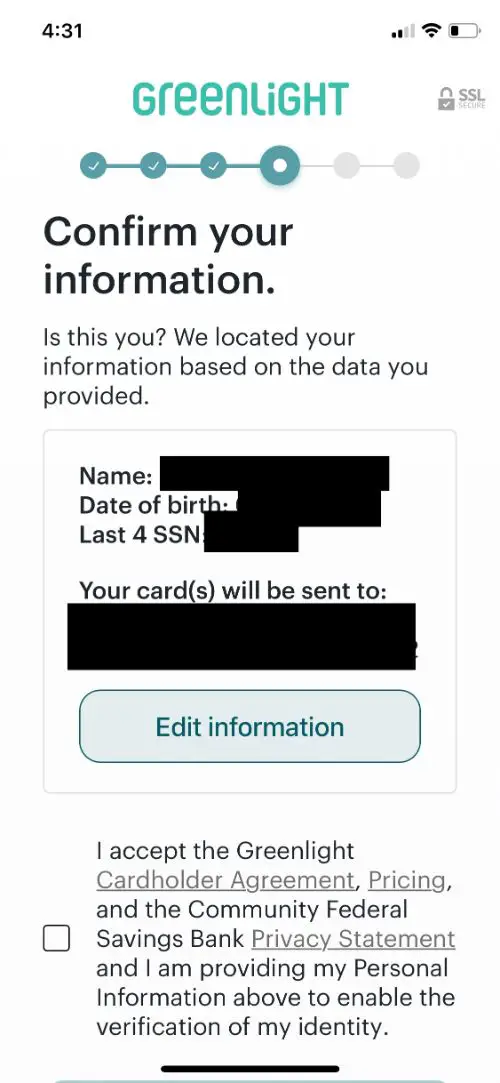

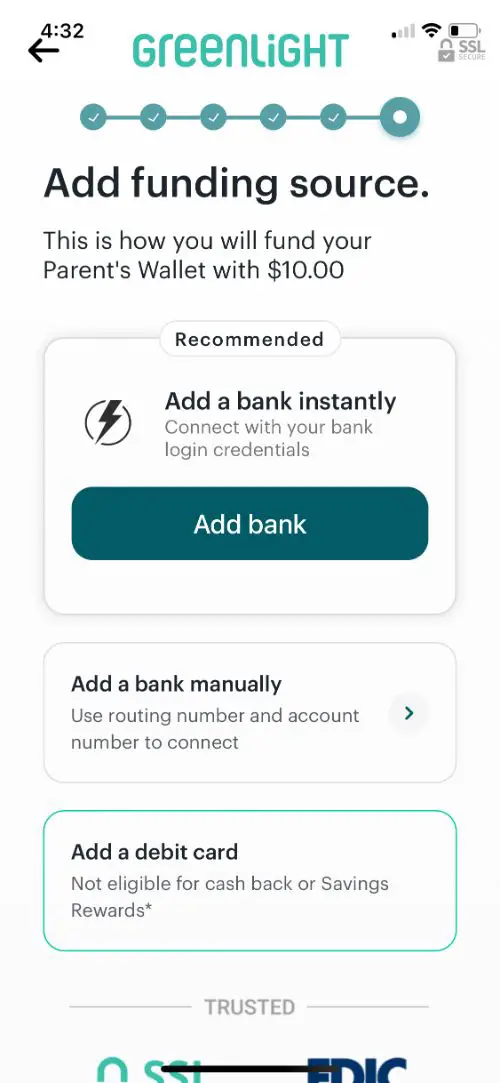

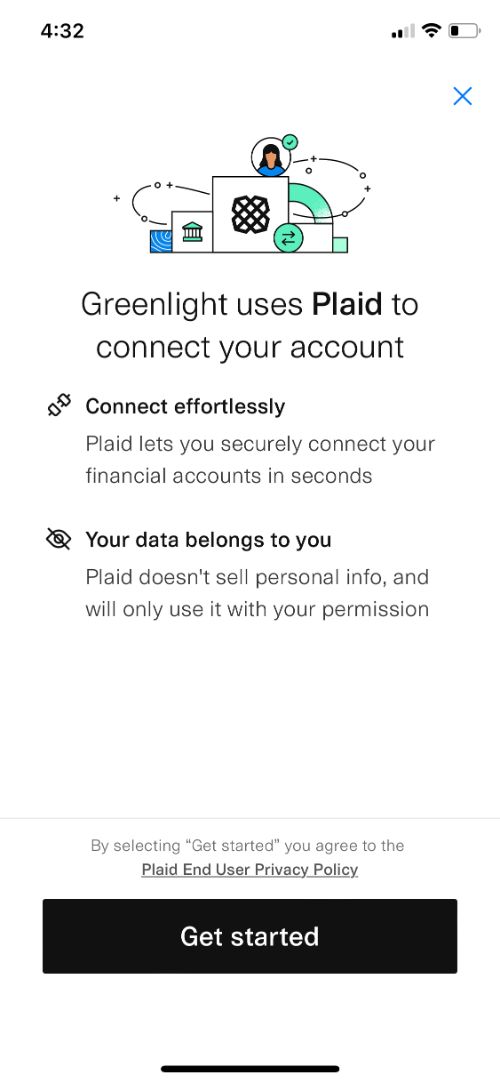

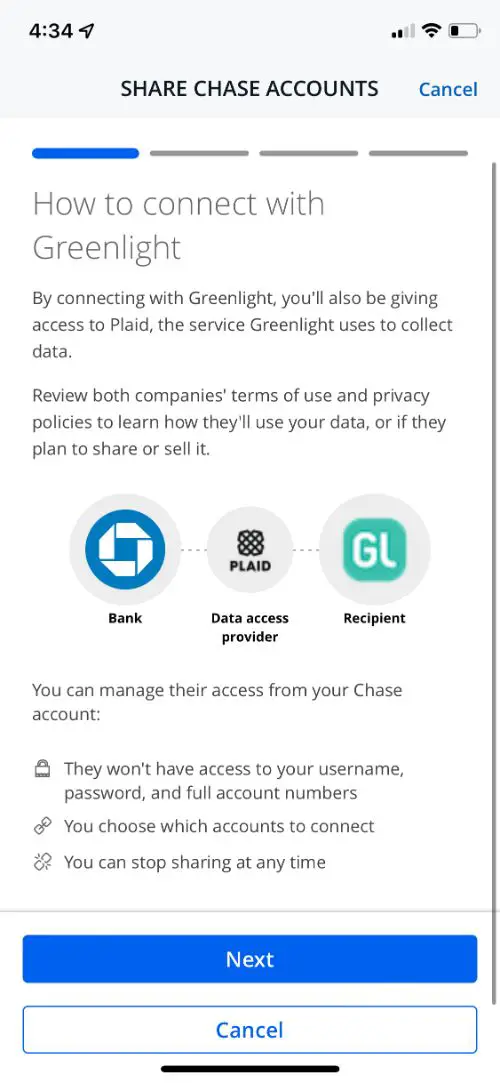

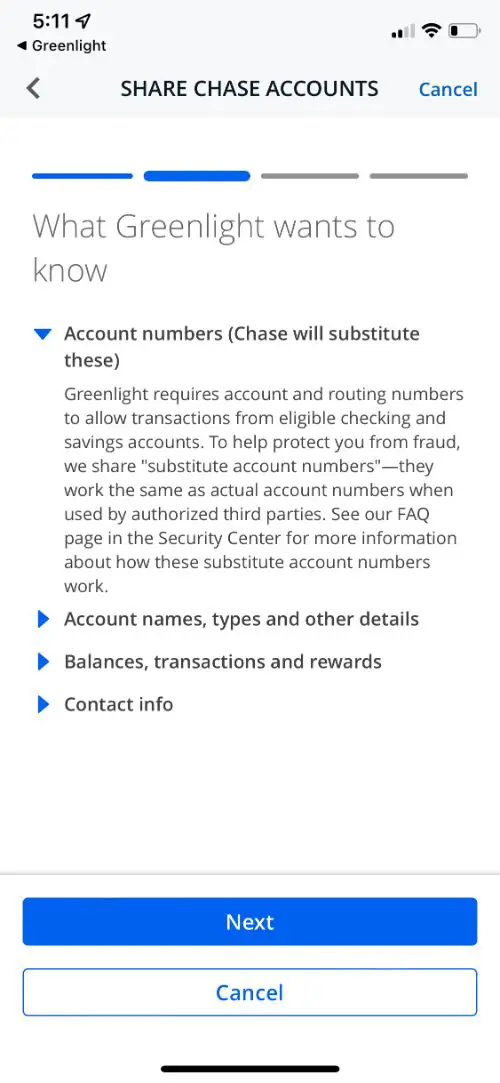

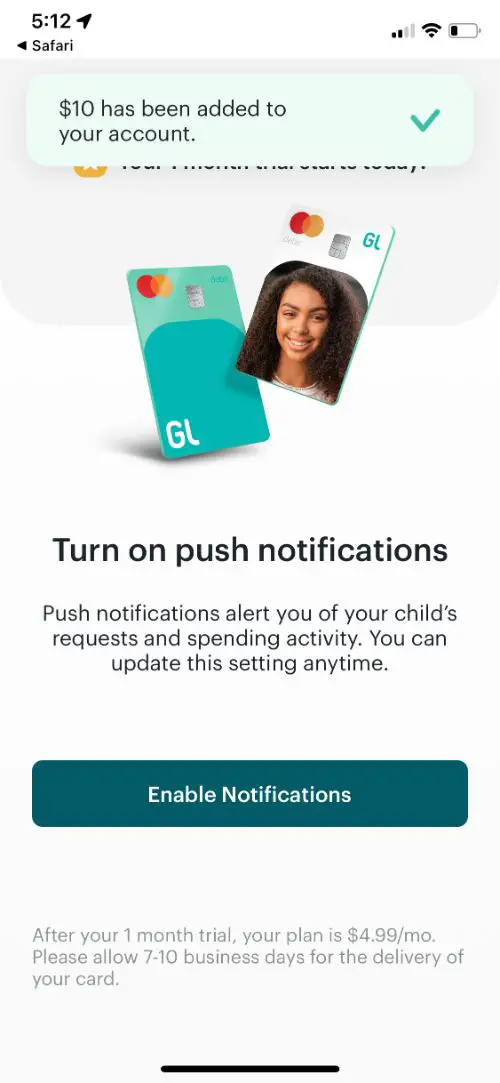

The next step is to fund your children’s accounts. In a couple of easy steps, I was able to link Greenlight to my bank account, and soon after that, I transferred some money to get them started. Once their cards arrived – which took less than ten days – they were all set up, funded, and ready to go!

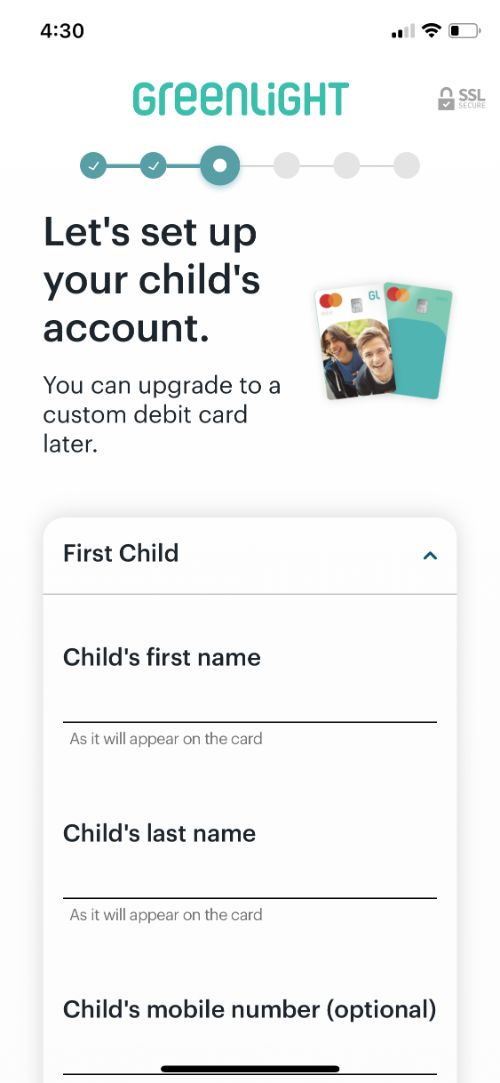

As a recap, here’s what you’ll need to open a Greenlight account and get debit cards for your children:

- Email address

- Mobile number

- Your name, birth date, and Social Security Number

- Mailing address

- Children’s names

- Valid debit card or bank account

The Nitty Gritty of Greenlight

So, that was the quick rundown of how Greenlight works. Here’s some of the info you’ll find in the fine print, which you may want to keep in mind for future reference:

- The monthly fee is $4.99, and this allows you to have up to five kids, each with their own debit cards

- Greenlight offers no-fee ATM withdrawals, but the ATM operator may charge a fee

- Lost card? The first replacement is free, but after that, Greenlight will charge you $3.50 every time you need a new card – I don’t know about you, but I let my kids know that fee would come out of their allowance if they lost their cards more than once!

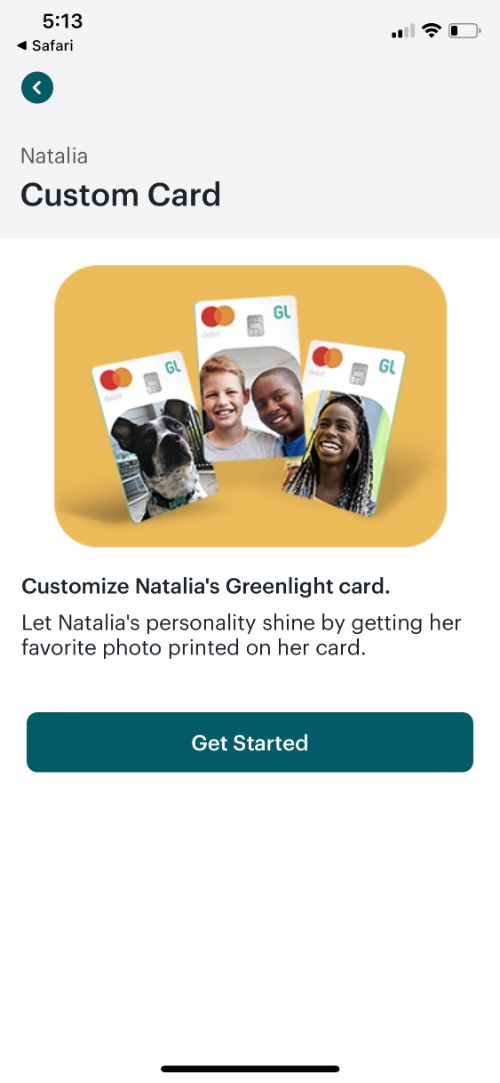

- Custom cards are fun and cute. The cost of each is $9.99, and when you’ve got more than one child, those fees add up quickly. So, I used this as an opportunity to have a conversation with my children about wants versus needs. We came up with a list of other things we could do with those $10, and they quickly decided that a regular card was good enough for them.

- The maximum card balance per child is $5,000.

- As a whole, your family has a monthly spending limit of $5,000 and $1,000 per day.

- The above limits also apply to purchases.

- There’s also a limit on how much you can deposit to your children’s accounts. That’s a daily max of $500 for the entire family and $5000 per month.

Favorite Greenlight Features

One of the biggest perks that Greenlight offers parents is the level of parental control. Personally, I consider myself lenient about where my children shop or dine. But I’m not a fan of video games or other apps that get children to spend their money on extras. So, I took advantage of the Spend Controls feature to ensure my youngest wouldn’t waste all her allowance on in-game bonuses.

When it comes to my teenager, she’d lose her head if it wasn’t attached to her body! But half the time something’s missing, she (or I) will find it inside her backpack or somewhere in her bedroom. That’s why the Freeze feature is such a peace of mind. If and when she misplaces her debit card, we can simply freeze it and activate it again when we find it.

On the kid side, your child will also find a chore chart especially designed for parents who connect allowances to housework. In my case, I prefer to set a fixed weekly allowance that’s independent of home responsibilities or grades. But parents who tie their kids’ allowances to completing a to-do list would probably find this feature handy.

Is Greenlight Safe?

In my opinion, yes. As most parents, I wanted to ensure that my children’s information and money were safe with Greenlight. Here’s what I found after doing some research:

- With Mastercard’s Zero Liability Protection, you’re protected from fraud or unauthorized transactions on your account.

- As an FDIC-insured financial tool, the funds in your Greenlight debit card are FDIC-insured up to $250,000.

- Data encryption ensures that your private information stays protected.

- Instant alerts let you stay on top of every transaction your child makes, so you can help them manage their money or quickly catch any suspicious activity.

- There’s a dedicated 24/7 customer support team ready to assist with any account-related emergencies.

- When you sign up for Greenlight Max, you receive identity theft monitoring and restoration for your entire family.

Pros of Greenlight

In all honesty, I was a little hesitant to give Greenlight a try. I was concerned that my oldest would find it gimmicky and childish, and I was worried that my youngest would feel uninterested in the educational aspect of it. However, I needed a convenient solution that helped me manage both allowances and keep an eye on their financial decisions in one place.

I’m happy to report that Greenlight was a big hit with both of my kids! When I asked, they said that these were the biggest pros for them:

- The app is easy to navigate.

- There’s lots of content to help them learn more about money matters.

- The chore chart can actually work as a reminder to get stuff done at home.

- The ability to set up savings goals and stay motivated to reach them.

- The Round Up feature is an easy way to put spare change to good use and save a little extra money without even realizing it.

As a parent, here’s what I like most:

- Parent-paid interest allows me to reward my kids when they set money aside for savings.

- It works as a centralized allowance management tool that helps me handle all kid money matters in a single app.

- Real-time alerts that offer peace of mind for me to stay on top of my daughters’ financial transactions.

- While we haven’t tried this yet, I’m excited to check out the Investment feature that’ll let my kids experiment with building generational wealth with guidance from me.

Cons of Greenlight

My kids have no complaints about Greenlight. I know because I asked.

As far as I’m concerned, Greenlight does have some room for improvement. Here are the areas where I think they could do a better job:

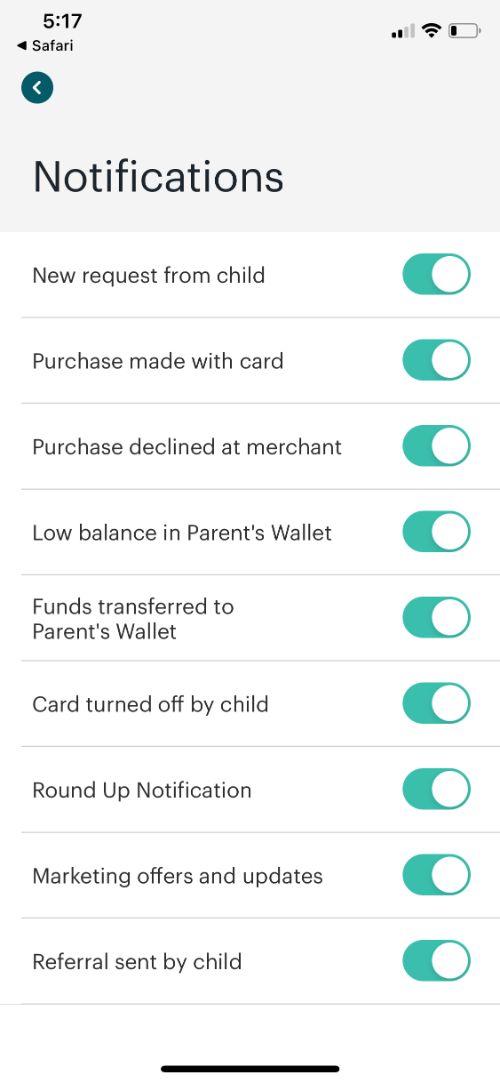

- As soon as I signed up for Greenlight, I started getting more emails and notifications than I would’ve liked (but I was able to curb them after adjusting my settings).

- In case of emergency, Greenlight doesn’t allow you to deposit cash into your kids’ accounts.

- While I appreciate the parent-interest feature, I think that Greenlight could also pay kids interest on their savings – like other financial institutions.

Greenlight vs. Other Prepaid Cards for Kids

When comparing Greenlight to other prepaid cards for children, I’d say that the biggest benefit is having one platform for all kids’ financial matters. If you have multiple kiddos and little time to spend on paying allowances, I would suggest Greenlight.

The platform makes it especially easy to track your children’s spending, keep a close eye on any suspicious activity, and monitor their investments if you choose to upgrade to the Greenlight Invest membership.

You can read about my experiences with other prepaid debit cards for kids below.

- My GoHenry Review

- My BusyKid Review

- My FamZoo Review

- My Chase First Banking Debit Card Review

- My Copper Banking Review

- My Step Banking Review

Green Light on Greenlight!

Greenlight is a debit card that helps parents teach children about money management, while providing several resources and making it easy to see what your children are doing with their money at any point. It puts everything in one place and makes it easy to track transactions from your phone. If you’re looking for a tool that helps your kids learn about money management and makes it easy for you to manage their allowances, Greenlight might be worth the monthly fee. I didn’t select it as one of the best debit cards for kids and teens, but it’s still a solid option for some families and is a great budgeting app for teens.

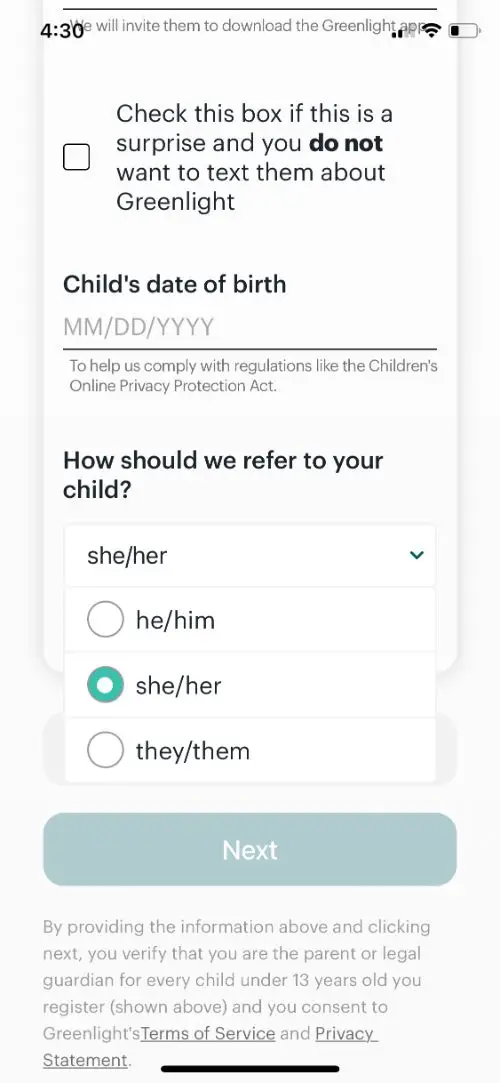

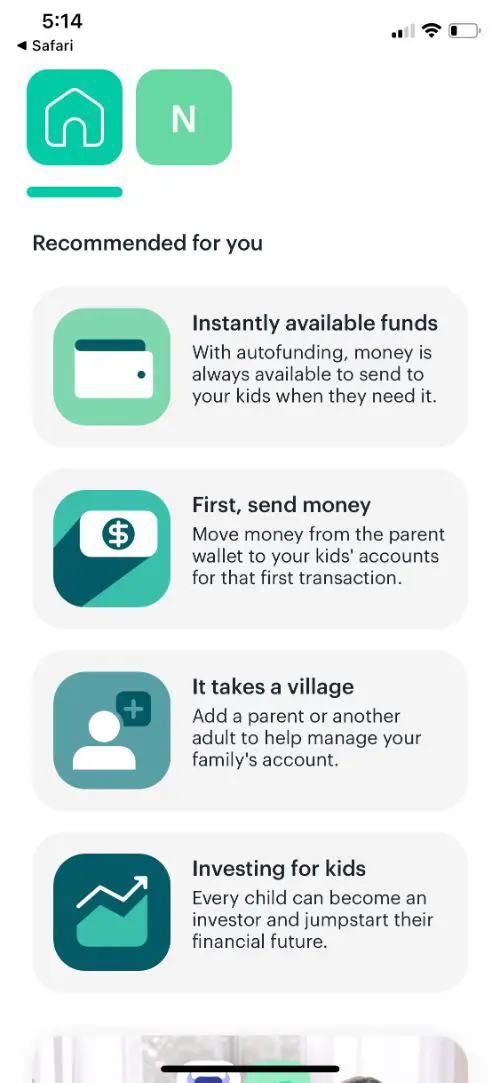

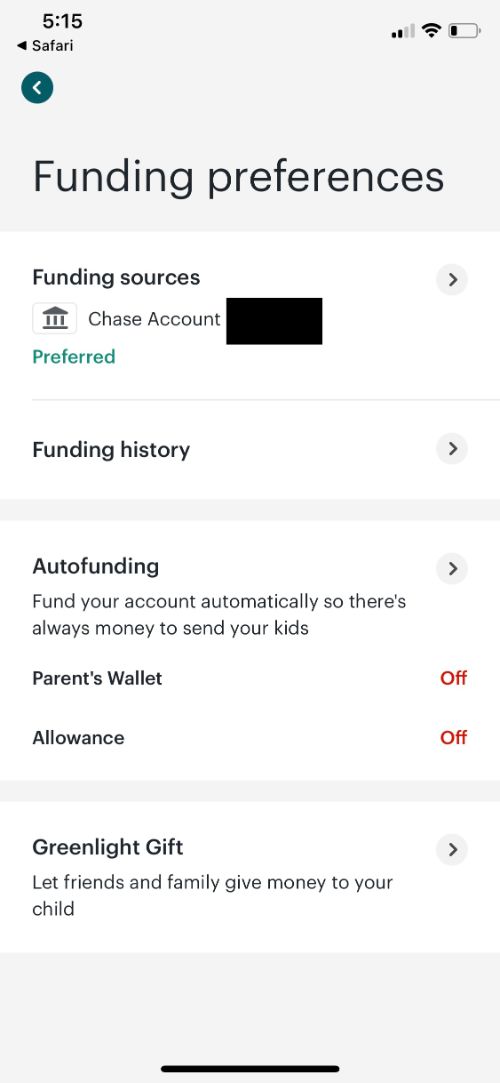

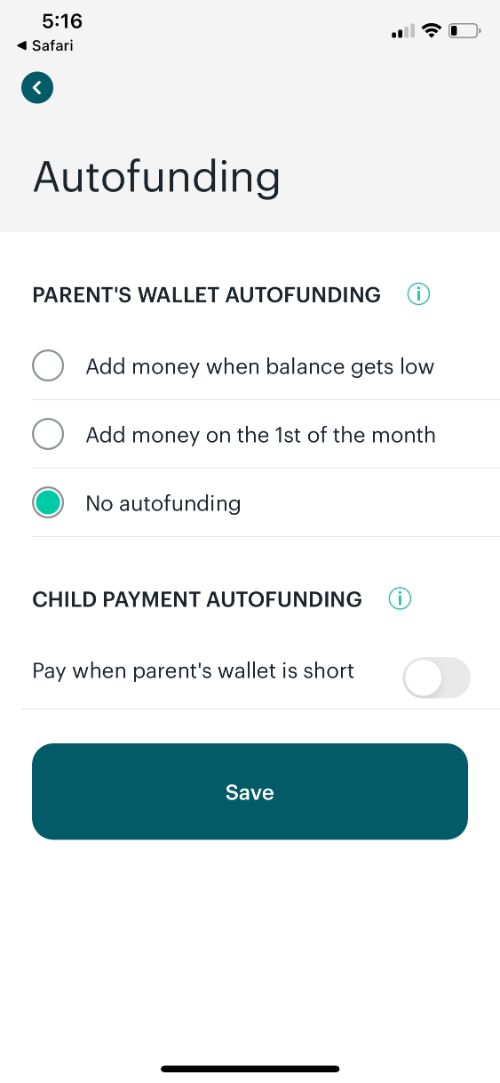

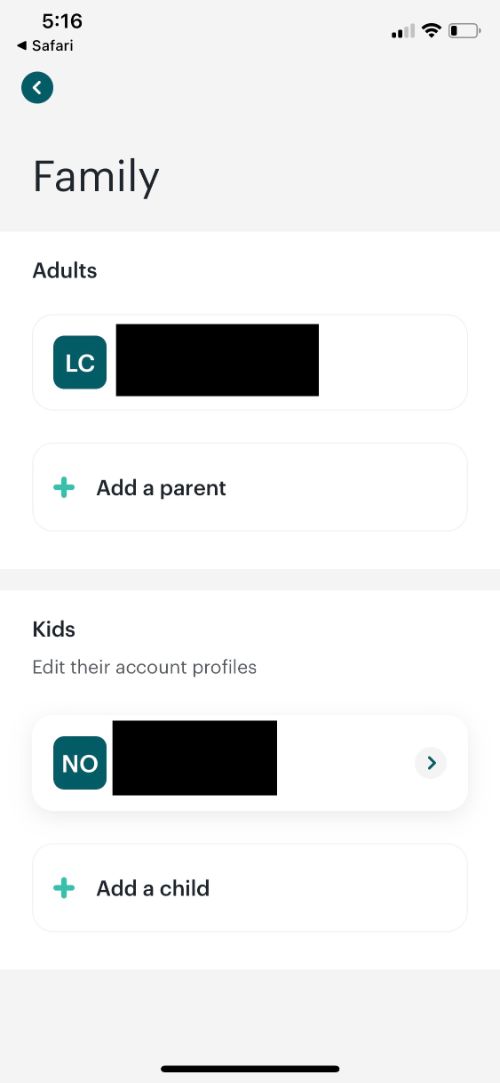

Screenshots From My Experience